Is 2020 going to be the year when European startups start to poach talent from the US? Is it going to be the year when American money pours into Europe?

Or will this be the year when remote working finally takes off, bullshit startup mission statements die and impact startups dominate?

These are just some of the big predictions for 2020 made by some of the brightest minds in the world of European startups — from investors such as Index Venture's Jan Hammer, founders like Taavet Hinrikus from TransferWise and community builders like Roxanne Varza from Station F — brought to you by our team of startup reporters across the continent.

There is not much they agree on, except that 2020 is going to be another huge year for the development of the European startup scene.

It's a bit of a monster list of luminaries, so we suggest you click and jump to the ones that look interesting. We have also tried to theme them by job role. Please read, share, discuss and disagree.

The investors predict

- The year US venture money pours into Europe — Hussein Kanji, partner at Hoxton Ventures

- The year Europe poaches talent from the valley — Ophelia Brown, partner at Blossom Capital

- The year of economic crisis (where startups are winners) — Philippe Collombel, general partner at Partech

- The year bullshit startup "mission statements" die — Daisy Onubogu, head of venture scouts at Backed VC

- The year of the data startup — Jan Hammer, partner at Index Ventures

- The year of the purpose-driven startup — Tom Wehmeier, partner and head of insights at Atomico

- The year of the electric tipping point — Agate Freimane, investment director at Norrsken Foundation

- The year of light — Alice Newcombe-Ellis, managing partner at Ahren Innovation Capital

- The year travel tech beats fintech — Jean de La Rochebrochard, partner at Kima Ventures

The founders predict

- The year fintechs go global — Hiroki Takeuchi, cofounder and chief executive of fintech GoCardless

- The year digital health grows up — Claire Novorol, cofounder of healthtech startup Ada Health

- The year that fintech gets real — Taavet Hinrikus, cofounder and chairman of fintech TransferWise

- The year of the experiential retail store — Brent Hoberman, cofounder and executive chairman at Founders Factory, Founders Forum and firstminute capital

- The year chickens start eating bug-food — Antoine Hubert, cofounder and chief executive of insect farming startup Ynsect

- The year of B2B fintech — Anne Boden, founder and chief executive of UK challenger bank Starling

- The year of Poland — Pieter van der Does, cofounder and chief executive of fintech Adyen

- The year of the employee — Phil Chambers, cofounder and chief executive of employee engagement platform Peakon

- The year of flying taxi prototypes — Remo Gerber, chief operating officer of flying taxi startup Lilium

- The year of offensive AI — Poppy Gustafsson, co-chief executive of cybersecurity company Darktrace

- The year of European ambition — Frank Thelen, German serial founder, tech investor and TV personality

The ecosystem builders predict

- The year we talk about values more than unicorns — Roxanne Varza, director of startup campus Station F

- The year of impact startups — Gerard Grech, chief executive of UK startup network Tech Nation

- The year of community coworking — Gabriela Hersham, cofounder and chief executive of coworking space Huckletree

- The year of technological sovereignty — Matt Clifford, cofounder of company builder Entrepreneur First

- The year of the impact startup — Travis Todd, cofounder and chief executive of Berlin startup community Silicon Allee

- The year of remote working — Nicolas Colin, cofounder and director of French startup community The Family

- The year of professional coaching for founders — Dave Bailey, founder, mentor and startup chief executive coach

- The year of the fintech bundling — Miguel Vicente, head of Barcelona Tech City

- The year of the robot — Daniel Dines, cofounder and chief executive of Romanian unicorn UiPath

The year bullshit startup "mission statements" die

I think 2020 will be a year of greater nuance. We're reaching saturation point on glibly mislabelling things in order to tell a convenient story. In particular, I think about three words that have been everywhere in 2019: "mission", "community" and "diversity".

Not everything is a mission, but we've allowed so many startups over the last few years to take that powerful word and stretch it to cover everything under the sun. It boggles the mind that someone could boldly call putting nice luggage in people's hands a world-changing mission.

At some point we figured out that if you tell ambitious millennials that they are doing something that matters they are willing to sacrifice personal wants, needs and preferences. Companies who can't really claim mission to simply win and retain talent by catering to those wants, needs or preferences, have been trying to masquerade for the sake of keeping personnel costs low and margins high.

Ditto community, we finally noticed that if people feel a sense of belonging it generates powerful energy and goodwill that can serve as an incredible catalyst for action that you'd normally have to pay or beg to make happen. Actions like evangelising our products, paying a premium for it, or staying stubbornly loyal no matter what.

Calling everybody who buys your product part of a community when you have done nothing to foster meaningful bonds between them is a lie. Calling everyone who uses your coworking space a community because they are spatially close and you host a Thursday evening yoga class is a lie; and none of it will hold for much longer.

It's only easy to convince people that any old nonsense is community until they have real spaces of belonging in their lives to measure against. Those spaces are a-coming. More organisations seeking to create community for its own sake or in order to leverage it are going beyond lip service, are bringing in people who get community, and committing real resources to make it happen. Those who don't want to bother will find themselves left behind real quick.

- Further reading: Where are all the UK’s black VCs?

Finally, diversity. Frankly, I don't even know where to start. I suppose the gist of it is: I'm hoping more than predicting that 2019 is the end of the first wave of "tick-box diversity action" defined by well-intentioned empty talk and putting illusory change in place for appearance’s sake in order to act as a shield against diversity-related criticism.

I really believe that with the rise of diversity-focused funds, and funds with champions of diversity and inclusion (D&I) on the investment teams, you're going to see more founders who are women and people of colour (POC) get their day, and that they are going to keep building companies in ways that reject the status quo and, before you know it, we won't be begging anyone to change, it'll be adapt or die.

The biggest worry for 2020?

I'm concerned that addressing the biggest societal issues we're facing (climate crisis, inequality, etc.) will require real sacrifice and uncomfortable choices that we, in our obsession with win-win solutions, will avoid until it's too late.

The most exciting sector for 2020?

Legaltech. It's been one of the slowest sectors to be meaningfully disrupted or augmented by tech. Now that some of the base/entry products are in place already, I think there's room for the unboxing of legal fees and complexity when it comes to process and documentation; these solutions should end 2020 in game-changing positions.

The company to watch in 2020?

Afrocenchix. One of the smartest and hardest-working teams I've ever met, and hustlers through and through. They are staring down a gigantic and grossly underserved market and have everything it takes to execute. Plus, Rachael and Joy are the sort of founders who truly care about the type of company and workplace they build to get there.

The year fintechs go global

I believe that 2020 will be remembered as the year fintechs truly go global. Not only is this an exciting moment in our industry, it crucially introduces innovative business models to new markets, helping to solve pain points for consumers and companies around the world.

You could argue this trend is an extension of how we ended 2019. This year numerous fintechs, from Monzo to N26 to TransferWise, either made their first push into new markets or continued to expand their international footprint. At GoCardless we announced the world’s first global network for direct debit. Soon American-grown competitors such as Robinhood will be coming to our shores.

All this means businesses and individuals will have access to — among other things — easier banking, more transparent exchange rates, commission-free investing and a simpler way to collect international payments.

- Further reading: Brunch with Hiroki Takeuchi, founder of GoCardless

This trend represents a step-change in financial services: moving from a group of traditional providers that offer a wide range of products in a specific geography to fintechs with much more focused offerings that expand all over the world. We’ll all face challenges as we enter different markets, from adapting to customer behaviour to navigating regulatory environments. But whatever the outcome, the shift is a welcome one as we reach the tipping point when fintechs can really play our role in fixing financial services on a global scale.

The biggest worry for 2020?

Brexit and the uncertainty it continues to create

The country with the biggest step-change in startup ecosystem?

The trend is more towards technology spreading across all countries. There has never been a better time to start no matter where you are from!

Hiroki Takeuchi is cofounder and chief executive of London-based fintech GoCardless

The year US venture money pours into Europe

Europe is on the map of US investors. This side of the pond was all too ignored in the past, with most US companies choosing to focus instead on China, Israel and India.

That’s all rapidly changing. Many of the top US firms — Benchmark, Battery, Lightspeed, Khosla, Kleiner, NEA, Sequoia — are already regularly flying over, courting European entrepreneurs, leading rounds, and competing with and beating incumbent European venture firms.

I see 2015 to 2018 as the experimental years, where much of US activity was centred around investing in the growth stage of a company. 2019 was the year where these companies began to test the hypothesis that they should broaden their activities to earlier stage rounds. 2020 is going to be the year this activity becomes mainstream and where even more companies follow the US leaders.

I wouldn’t at all be surprised to see more US companies announcing a formal presence in Europe. I also wouldn’t be surprised if more and more of the highest potential companies end up taking money from the US venture funds, who will deliver more access, knowledge and networks than the local firms.

For some there will be a dent in national pride and for others we might start hearing more complaints about deals getting too competitive and expensive.

As a whole, this is going to raise everyone’s game in Europe. I think a lot more entrepreneurs will soar to greater heights and create a lot more wealth, which will only accelerate the virtuous cycle of starting great companies from Europe.

The biggest worry for 2020?

More tourists rushing into tech sector (which increases probability of disasters in future years)

The country with the biggest step-change in startup ecosystem?

France. The minister of European affairs has vowed to get to 25 unicorns in two years (which can easily be done by pumping dumb money into the system). But the ecosystem in Paris today is night/day compared to five years ago.

Hussein Kanji is a partner at London-based VC Hoxton Ventures

The year we talk about values more than unicorns

There were quite a few times this year when I heard key people in the ecosystem frustrated with how much attention is given to huge rounds of funding and unicorns.

At the same time we saw a huge shift with regard to values. Some of our ecosystem's leading chief executives have shown that they don't always uphold their values when big money is involved — leaving the rest of the ecosystem in a bit of an existential crisis and consumers conflicted, if not downright disgusted.

In 2020 I believe the ecosystem will make a shift away from financial obsession and more towards values obsession, with more emphasis on the role of investors. Not only are consumer trends moving towards more value-based businesses, but investors have a key role to play in the types of businesses and business practices that we enable in our society.

- Further reading: Brunch with Roxanne Varza

At Station F we will require that every single one of our 1,000 startups adhere to basic values, diversity and sustainability criteria. It isn't enough just to have good metrics, you need to show that you're actually using them for good. And we think it's only a matter of time before funds insist that their portfolio companies do the same.

The biggest worry for 2020?

Fake news

The most exciting sector for 2020?

Companies founded by underprivileged entrepreneurs

The companies to watch in 2020?

Neoplants, AgenT Biotech, DigiTall Paris

Roxanne Varza is the director of Paris startup campus Station F

The year of economic crisis (where startups are winners)

My prediction for 2020 is going against the current: a financial downturn is likely to follow an economic slowdown, but contrary to what a lot of people seem to think, it’s going to be large companies that suffer the most, not European startups.

As a result, there might be a dichotomy between large companies and startups in this coming crisis. Startups will be more resilient because the general state of things in the European tech ecosystem right now is that three out of four companies have business models that are very sound and very solid management teams.

Tech isn’t overvalued, I don’t believe that. There are a few problematic cases here and there, usually very visible ones, but these are anecdotal. There’s no broader negative trend. On the contrary, entrepreneurs are exceptional, startups are able to attract the best talent and they’ve got costs under control. They have a better hold on their unit economics (and access to them in real time) than most larger companies.

This overall trend that I’m describing has a downside for investors though: it means that the problem of finding an exit will pose itself even more acutely. Europe’s biggest companies today still haven’t fully grasped the opportunities that lie for them in the tech and startup space. Contrasting with that timidity, I think we’ll see an inflow of capital from China and takeovers of European startups by Chinese companies. Of course that, in turn, could have important consequences for European innovation.

The biggest worry for 2020?

Lack of exit possibilities in the EU tech ecosystem. Excluding the few major floatations, in 2018 there were less exits in than during the year before that.

The most exciting sector for 2020?

Artificial intelligence is becoming real.

The company to watch in 2020?

UK global marketplace software as a service company Shedul, which owns the platform Fresha.

The region with the biggest step-change in startup ecosystem?

Scandinavia. It has had a tremendous rise, contrasting with Germany’s weakness.

Philippe Collombel is general partner of global venture fund Partech

The year Europe poaches talent from the valley

When we started Blossom we believed startups would continue to raise Series As from investors who could support them on the ground, but that at growth stage we'd see a global flattening, with the best growth funds investing in the breakout companies wherever they're located in the world.

That's started happening faster than we ever expected, with many of the top US growth funds committing to partner time on the ground in Europe and some going as far as hiring local teams.

European founders are increasingly building global businesses from day one. We now frequently see both business-to-consumer and business-to-business startups in Europe who, even at Series A, already have the largest proportion of their revenue or users originating from the US.

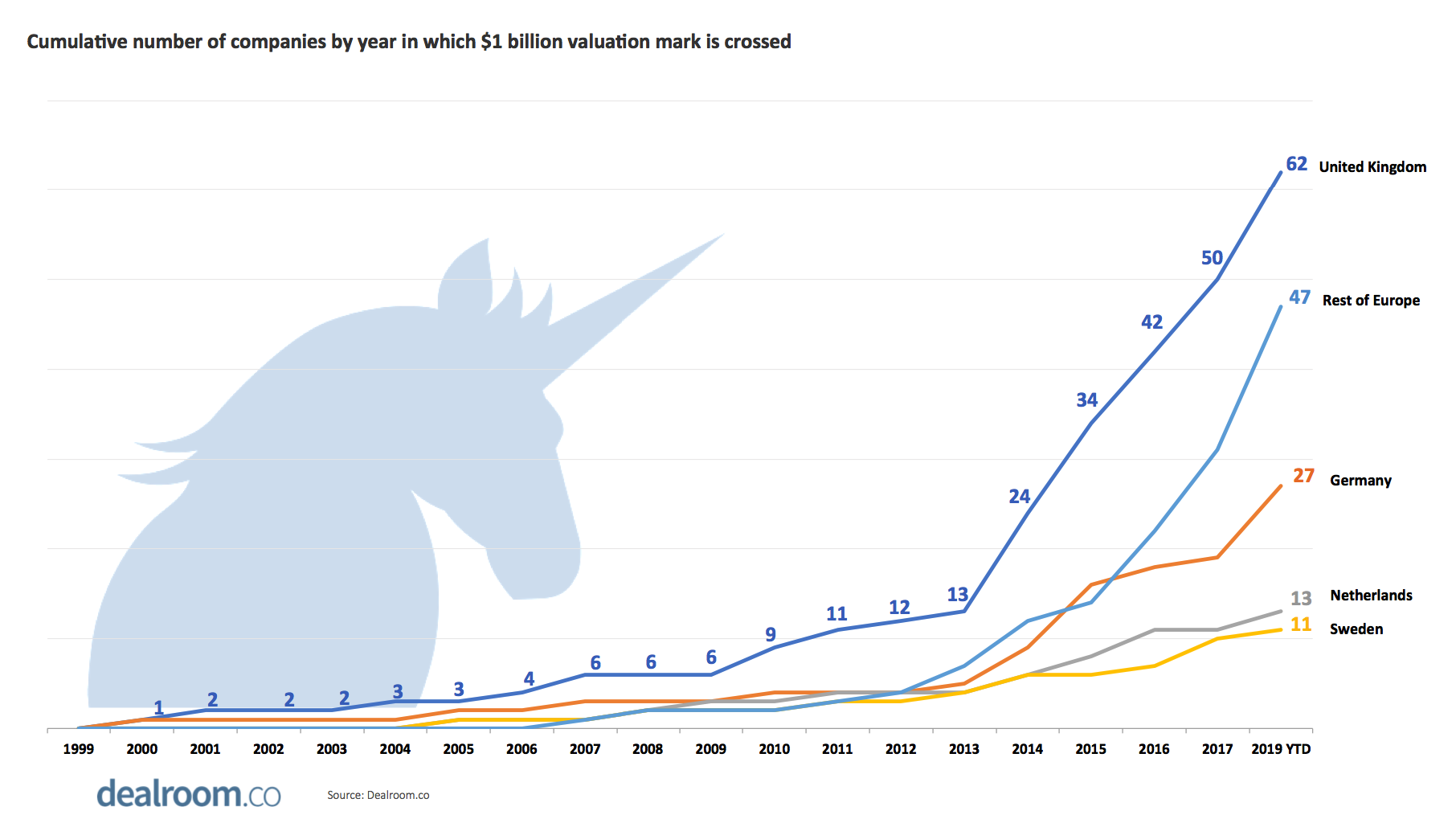

As we move onto Europe's second and third generation of unicorns, startups are able to poach experienced engineers, product and growth hires who've seen what it takes to build for hyper-growth — really taking the calibre of people talent to a level comparable to the valley.

This combination of factors is capturing the attention of top tier international growth investors. We see 2020 as a real turning point: the year that we'll see a majority of the top US growth funds actively investing in European startups at the growth stage.

The most exciting sector for 2020?

Travel

The company to watch in 2020?

The country with the biggest step-change in startup ecosystem?

Germany

The year chickens start eating bug-food

In 2020 we will hopefully get EU approval for insects to be used in chicken feed and also approval for some species to be used for human consumption. Ynsect currently sells its insect protein for luxury dog and cat food and for fish feed, but chicken feed would be an important new market. Opening up the market for pigs will come much later — in five years.

Using insects in fertiliser should also get the green light next year. At least in France you wi