What makes a healthy, thriving startup scene?

Five years ago, when I was at Google leading Campus, the east London space for entrepreneurs, our partners at UP Global/Techstars released a popular white paper that emphasised how essential five elements were for startups to succeed; talent, regulation, density, capital and culture.

But five years is a long time in startup land and it’s clear there’s an ingredient that paper misses which sits between talent and institutional investment: great angel investors.

These individual backers are the first money into a startup, often when what you’re funding is a person or team with a promising idea rather than a company — and they can make or break a business.

In Silicon Valley, it’s become pretty cool to use your hard-earned equity to fund the next big things. There's an increasing trend towards micro VC — such as podcast host Harry Stebbings’ new fund, 20VC, which sees him investing $8.3m on behalf of 64 backers — and a wave of solo operators building their brand and profile around particular expertise.

As the European startup scene continues to mature, we’re lucky to have some incredible angels here — think Robin Klein or Sophia Bendz — but, as we pull ourselves out of a pandemic and through a recession, it’s time to supercharge.

We need more angels

The US has a markedly different attitude towards investing than many of us in Europe. 55% of Americans own stock (note: this includes non-technology companies) compared to, for example, 12% of Brits.

Add to this a less mature tech scene and it makes sense that so far, angel investing has been for the few, not the many. Exits have been growing, which create liquidity to invest for both founders and startup employees; for example the Cambridge startup scene was strengthened after Arm’s sale. And alumni syndicate groups continue to grow and act as entry points; a way to assess deals collaboratively and learn from more experienced angels in the group.

We need angels with skillsets and specialisms far beyond conventional tech skills to join the party.

But tech isn’t a standalone industry, a vertical of its own, in the way that it used to be. We’ve seen software revolutionise industries from healthcare to government, so we need angels with skillsets and specialisms far beyond conventional tech skills such as product or growth to join the party.

If we can unlock the value of everyday investors — matching lawyers to legal-tech, helping farmers fund innovations in agtech — there’s so much to be gained. For one thing, with only 8% of European VCs coming from operator backgrounds, it would help provide founders with perspectives some of their later-stage funders can’t. And, while there’s of course risk involved, the sector expertise that a broader range of angels brings can be lucrative, as they’re able to spot opportunities more conventional angels might miss — useful in an era when savings accounts are peaking at 1% interest.

Programmes like Andy Ayim’s Angel Investing School and the UK Business Angels Association's angel investing course are great starts, but we need more pathways to welcome in a new wave of angel investors.

We need better transparency

For these pathways to bring in new and diverse angels — in terms of skillsets, demographics and more — transparency is essential.

Thankfully, I don’t hear pre-seed rounds called “friends and family rounds” so much these days (I’m not sure about you, but my parents definitely don’t have $500,000 lying around). If we want to diversify who gets to start and grow innovative tech companies, we also need to diversify who funds them, and how founders learn about and access those angels. It used to be that you had to know someone to get an “in” with the angel community; some angels wanted to remain under the radar. But it’s a mistake to think warm introductions result in quality deal flow; it’s clearer than ever how much value we leave on the table when we narrow who gets access.

If we want to diversify who gets to start and grow innovative tech companies, we also need to diversify who funds them.

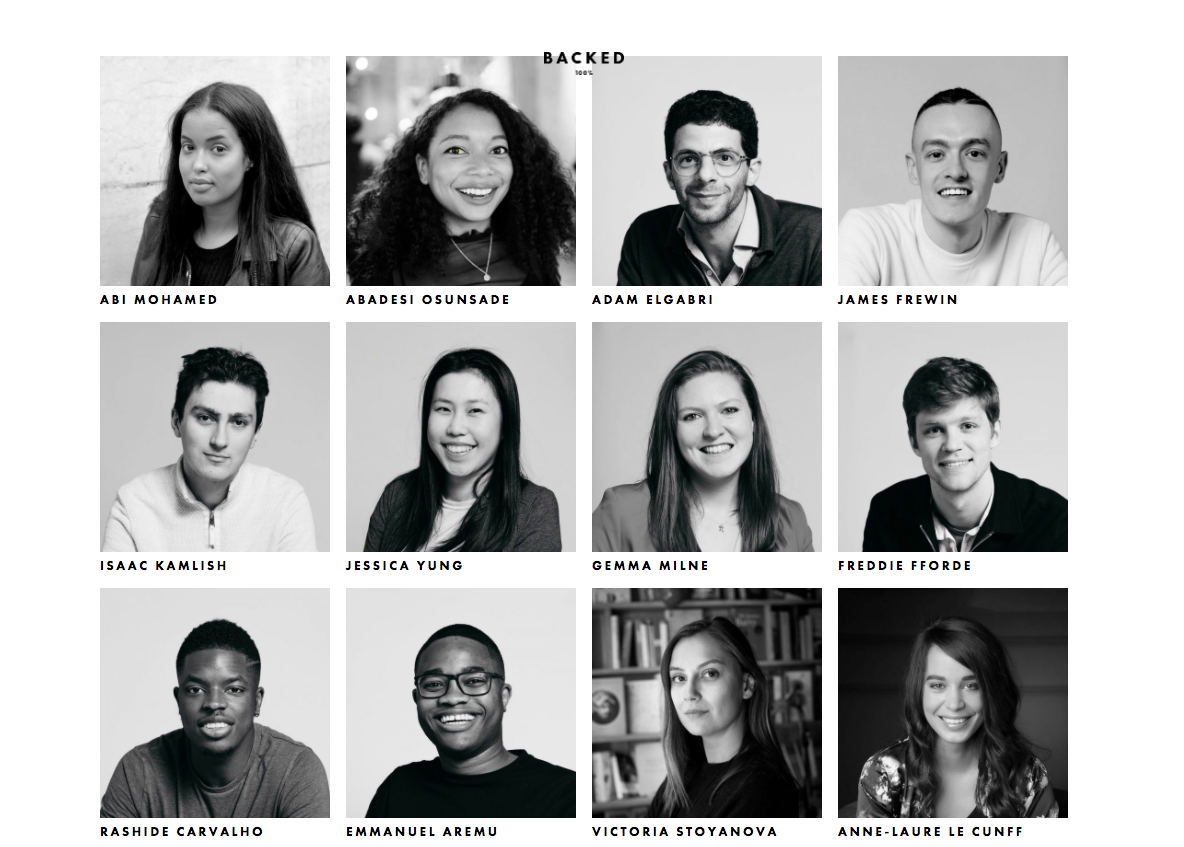

Recently, VC investor Pietro Invernizzi’s published a list of 35 angels (including me) working in Europe right now. When this piece went live, I had a hundred pitches in my inbox overnight. More of this, please.

But beyond the need for there to be easier access, we should also be frank about numbers. There’s confusion about cheque size; I’ve spent years working with early-stage founders and still found a lack of public data around standard entry levels. And the confusion isn’t just on the angel side; some founders and their institutional investors prefer to keep their cap table clean and focus on cheques of $50,000+ which locks out all but the most experienced or well-off angels; others are willing to go as low as $5,000 if the angel is strategic and adds value through expertise. Not to mention the a new category of micro-angel investments (investments of $100–$4,999) bubbling up through syndicates like Backstage Crowd.

And we need to leverage network effects

This year, I’ve been part of Atomico’s angel programme and it’s reminded me again of the incredible power of network effects. Three people looking at the same deal from different angles with different focuses can be incredibly valuable.

So it’s been great to see programmes like Alma Angels (led by my fellow Atomico angel Deepali Nangia) and Angel Academe thrive, and especially cool to watch VC funds like Blossom follow on with their own angel programmes.

But in a region divided by many different languages and consumer behaviours, there’s room for so much more. We need more programmes that create and upskill cohorts of new angels, programmes with vertical specialisms, scout groups that reward those with incredibly different deal flow and office hours that connect across geographies and networks.

Together, all this will help strengthen the startup scenes that already create such brilliant products, and allow a more diverse group of investors to contribute and benefit from that success.