It has been criticised as "Britain’s worst tax break" and today it has been dramatically scaled back.

Entrepreneurs' Relief reduces the amount of capital gains tax founders pay when selling shares in their company, taking the tax rate down to 10% — compared to the normal 20% — up to a value of £10m over an individual's lifetime. UK Chancellor Rishi Sunak held back from abolishing the measure completely, but cut back the amount of relief that can be claimed to just £1m.

That's the level of relief that was available when it was originally rolled out in 2008.

The original idea of the tax break was to encourage entrepreneurship, but organisations like the Institute of Fiscal Studies (IFS) have claimed it has had little impact. In 2017-18 the IFS calculated that the tax break — which cost the UK £2.3bn — mainly benefited a small group of wealthy people. Some three-quarters of the relief went to just 5,000 individuals, who made average tax savings of £350,000 each.

A similar study by think-tank the Resolution Foundation found that in 2015-16, some 82% of beneficiaries were men with a typical age of 57.

There have been repeated calls to scrap the tax break and allocate the money to public services.

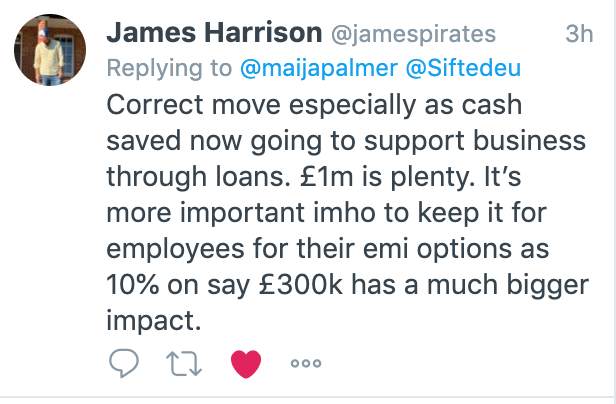

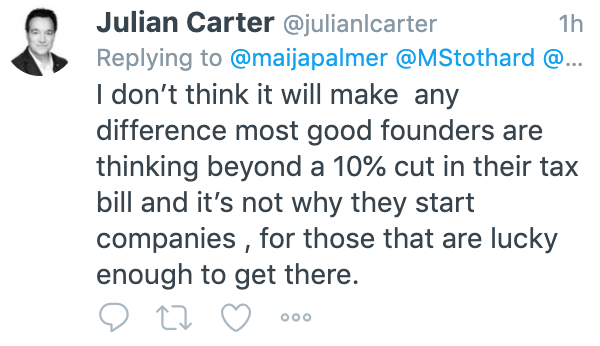

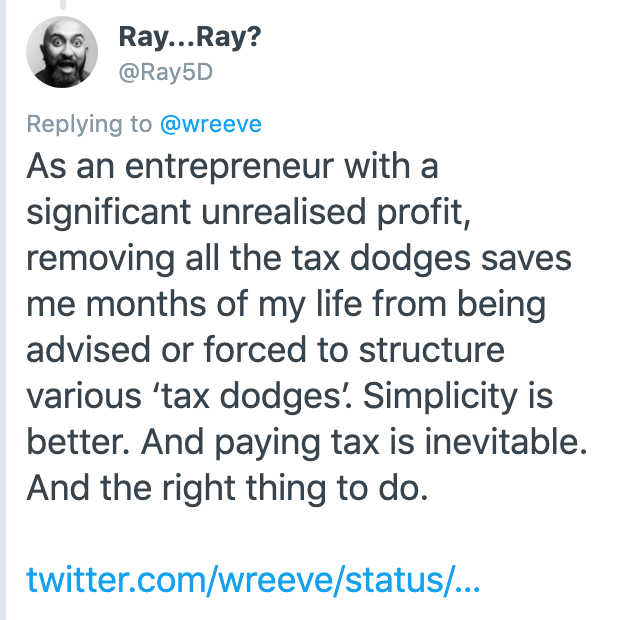

Apart from being a pretty exclusive benefit, there is another argument that it doesn't really work: no entrepreneur sets up a business — taking crazy risks and working insane hours — because of the distant promise of a tax break at the end of the company's lifecycle. Admittedly, there is little real research around this, much of this commentary is based on "gut feel" soundings from founders. (There was a great Twitter thread on this earlier in the year by William Reeve, a serial founder and now chief executive at Goodlord, the tenant management startup.)

Although not everyone agreed with Reeve. William Tunstall-Pedoe, who sold his natural language company Evi to Amazon (it was folded into Alexa and Amazon Echo), says the relief did inspire him to stay in the UK afterwards. So perhaps it the tax break is helpful at least in preventing entrepreneur brain-drain. (And by the way, we checked, Tunstall-Pedoe was only in his 40s when that Amazon deal was done so wouldn't have fallen into that 57-year-old-man category. In fact, he still doesn't).

Startup organisations like Entrepreneurs Network and The Enterprise Trust argue that it would be better to help startups and small businesses at the beginning of their life rather than at the end. Some one in nine small businesses in the UK are discouraged from seeking external finance, making it harder for them to scale up, they found in a recent study. A more effective way of boosting entrepreneurship, might, therefore to make it easier to get early-stage funding, for example by simplifying the process of getting Enterprise Investment Scheme (EIS) tax relief.

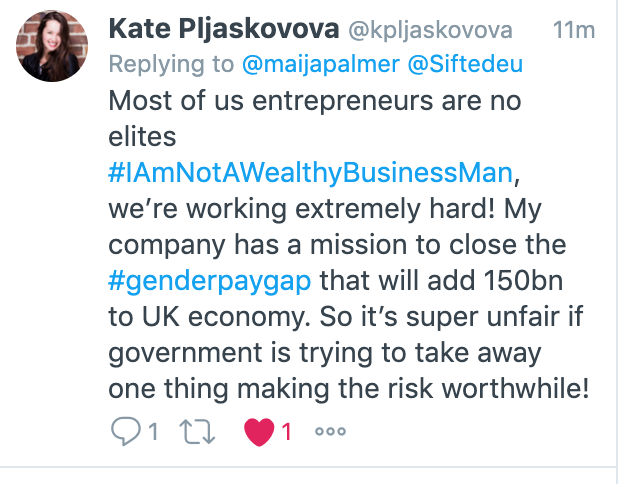

But what do entrepreneurs and investors think? Is it a pointless exclusive break for the rich? Or a helpful part of the UK's entrepreneur-friendly business environment? This is what we are hearing so far:

Sorry to see it go

Caroline Plumb, chief executive and cofounder of Fluidly, the cashflow management software business:

"It’s completely laughable the way business owners are being lambasted over Entrepreneurs’ Relief. The prime minister incorrectly dismisses around 90% of those who have used the relief as already 'staggeringly rich'. It’s been described as 'egregious'.

"I’m tired of the spin and a concerted campaign, which is really against the people who ploughed savings into creating independent stores, services and products we all love. They are the vast majority who deserve some payback for personally guaranteeing loans at great risk, creating good jobs locally, and coping with the sleepless nights that running your own business brings. They are the people who, through their businesses, fund our public services and welfare systems through corporation tax, business rates, employer’s national insurance and collection of VAT. Instead, we’re led to believe they are all millionaire businessmen in London. This is not the reality.

"Yes, the relief needs to be revisited, but don’t throw the baby out with the bath water. Lower the cap from £10m to £2m, introduce a longer qualifying period than the current two years, and increase the ownership threshold from 5% to ensure it is business owners who benefit. That’s the kind of levelling up we need."

Max Bautin, cofounder of IQ Capital:

"It is extremely disappointing to see changes to Entrepreneurs Relief — especially in the context of Brexit, claims of the ‘business-friendly’ agenda, and even the continued promotion of EIS in the budget. While EIS is a great scheme, the sole reason EIS and other investors benefit the UK economy is because of the entrepreneur — who in essence converts investors’ money into sustainable businesses that create jobs, pay taxes and generate growth in the local and national economy. These entrepreneurs create this huge economic and social value at the personal expense of taking extraordinary risks with their lives, careers, families — often working crazy hours in blind dedication and without any safety nets or guarantees.

“It would, therefore, be shocking for the 'pro-business' Government would ask them to pay tax many multiples higher than the investors who fund them."

Alex Cowan, chief executive of RazorSecure, the cybersecurity company:

"It is disappointing that they are removing a mechanism that is designed to encourage entrepreneurs to take a risk, generate UK jobs, UK exports and power the economy.

"This also punishes the employees who take a risk and join an early-stage company by reducing the relief on the EMI [Enterprise Management Incentive] share options schemes, money that would stay in the UK and can be invested in future ventures if they decide to take the same risk again.

"This relief is helping to create the next generation of serial entrepreneurs, the type of people who today drive many of the UK's strongest brands and most well-known companies. We should encourage them and give them the boost to invest in their next venture."

Tim Antos, chief executive and cofounder of Kokoon, the internet-of-things-focused wellness company

"The government’s support for early-stage businesses through the Enterprise Investment Scheme (EIS), R&D tax credits and Entrepreneurs’ Relief is essential to businesses like ours. Without incentives like these, we and many success stories driving economic growth and employment in the UK would simply not exist

"In my opinion, rather than adjusting the tax relief schemes, the government could do considerably better with grants. With the loss of the more significant EU grants, such as Horizon 2020, there is a vacuum of funding for longer-term innovation and deep technology. To fill this breach, the government may want to consider reviewing the Innovate grant process, where the administrative overhead can outweigh the limited financial upsides and boost the scope and ambition of these grants in a similar manner to the previous EU grants."

Matus Maar, managing partner and cofounder of Talis Capital:

"Measures to promote innovation, research and development and science-based entrepreneurial businesses are all very well but they sound a bit hollow with the decision to almost entirely scrap Entrepreneurs’ Relief. The UK should be celebrating entrepreneurship and the signal this sends is not great, particularly since the UK’s departure from the EU is already deterring founders from choosing the UK as a place to start or grow their business."

Megumi Ikeda, partner at Hearst Ventures:

“I was excited to see what feels like a real endorsement of the innovation economy with a £22bn commitment to R&D, help with startup loans and new funds for the British Business Bank, which backs some of the local venture capital funds.

“However, the dramatic scaling back of entrepreneurs' relief is a pity. The reality is that no entrepreneur starts a business because they might get some tax relief in the future. But it’s a pity the Government fails to bet on entrepreneurs in the way it has bet on R&D."

"Most entrepreneurs don’t actually get the windfall of tens and hundreds of millions that the headlines imply. Giving those people who have created jobs and income a bit of relief on capital gains should not be deemed a give away. A fragile but vital element of the startup ecosystem is having past entrepreneurs give their advice and early risk capital to new founders. Entrepreneurs' Relief helped experienced startup founders to pay it forward and seed the next generation of startups. We really need to embed this positive cycle if we are to begin to emulate Silicon Valley where it has been happening for decades.”

Mark McCusker, chief executive of Texthelp:

"What makes ER [Entrepreneurs' Relief] effective, is that it provides the motivation — for both investors and founders — to stay on with a company and support its growth. However, since the Chancellor has now announced that the lifetime limit for Entrepreneurs' Relief will be reduced from £10m to £1m, I would question how likely it is to be such a powerful motivator. This reduction in the limit will undoubtedly make life more difficult for business owners, particularly with attracting senior talent — something that is crucial for founders to take their business to the next level.

"Some would argue that lowering the cap would not have a massive impact, but with such a significant reduction, many founders will question whether the risk-return is worth it. The government should be encouraging entrepreneurs to take these risks and the announcement today does not recognise that those that benefit from ER will typically reinvest it into a new venture, or other promising high growth companies. Particularly in the tech industry that we operate in, capital is frequently recycled back into the ecosystem and this reduction is likely to be detrimental to the innovation economy, not just the individuals it directly affects."

Good riddance

Dominic Perks, cofounder and chief executive of Hambro Perks:

“Scrapping the tax relief is unlikely to deter many founders from starting and scaling their enterprises. Entrepreneurs tend to be creative, ambitious and motivated by ideas and the bigger picture. The prospect of Entrepreneurs’ Relief is not the driver behind entrepreneurs founding a company in the first place.”