In the first part of my guide to venture partners, I talked about the five different kinds of venture partner roles out there and tips for aspiring venture partners. This time, I want to turn the tables and talk about what VCs should think about when hiring venture partners.

First, VCs obviously need to figure out which kind of venture partner they need. For details on the five main types of venture partners, see my previous piece. Once it’s clear which one you are hiring for, you need to decide how to incentivise venture partners correctly.

Transactional or ongoing?

First, consider the nature of the role; is it transactional or is it about ongoing value creation? Venture partners helping with fundraising efforts (fundraising partners) and those helping with sourcing (sourcing partners) have a transactional element to their job. These kinds of venture partners should have incentives that align with their outcomes; i.e. a referral fee or carry points for each deal brought in.

Venture partners advising the portfolio (board / operational partners) or helping raise the fund’s profile with a certain audience (business development partners) are often hired on an ongoing basis. They are hired to create value for the partnership and their performance can be measured according to a range of metrics.

For example, an operational partner specialising in talent might be evaluated on whether she was successful in helping a company hire for key roles. Their incentivization tends to be more long-term, for example, fund carry or retainers. Many venture partners who work in long-term engagements also get the opportunity to invest their personal capital into the fund — sometimes on preferential terms alongside the investment team.

Transitioning or professional?

Second, a VC needs to consider where the venture partner is in their career. Are they transitioning or are they not looking to change careers?

Let’s call venture partners looking for a temporary home and community in a venture fund ‘transition partners’. They might be researching their next venture, considering joining a portfolio company or looking at joining your fund full-time. Most people in transition are looking for financial stability, optionality and direction, like Sathya Smith, former venture partner at LocalGlobe.

"Coming out of a nearly 12-year stint at Google, becoming a venture partner was a great way for me to find my feet again. The time I spent at LocalGlobe exposed me to both the world of venture capital (something I knew nothing about) and the amazing startup ecosystem in London and Europe," she says.

"My original intention was to find an exciting early-stage startup, get to know them and potentially join them. Somewhere along the way, I ended up starting my own company. The best benefit of being a venture partner was that it gave me options."

The second kind of venture partner is someone who isn’t looking to transition. These are typically specialized advisers; let’s call them ‘professional venture partners.’ They run their own boutique advisory practice or are employed somewhere. It might be their hobby to help investor friends or they might work with VC funds as a profession. In the latter case, these venture partners will likely have established engagement models such as advisory workshops or a coaching program.

In my role at Joyance, I was transitioning from a full-time investing role to a coaching role. I stepped back once my coaching business started to require my full attention. My roles with Backed and EF are more straightforward: I provide value within my existing deal flow (from my angel investing practice) and through my executive coaching for founders.

What are the options for incentivization?

A few weeks ago, we anonymously asked venture partners and managing partners in European VCs: How are you and your venture partners paid? Here is a menu of options for financial and non-financial ways of incentivising venture partners, peppered with insights from the survey:

- Monthly retainers: A retainer model helps provide stability to the partner. This might make sense for those who are in transition. It acts as a sort of downside protection. We have seen funds pay €500-800 day rates and retain venture partners for two or three days per week. The upper end of the payscale was €1k per day for short-term operational projects. Very often, fund-sponsored portfolio projects turn into company-sponsored advisor or full-time roles later on.

- Referral fees: Another way to provide upside is to pay a transaction-based referral fee. I have seen this both in the context of deal flow and in fundraising. This option is typically reserved for larger, established funds that have enough management fees to work from. For deal flow, we have seen cash bonuses of 1% of the amount invested into the company. If the venture partner invested their own capital, the fund would often mirror that amount until a cap (typically below €50k). This is very dependent on the fund stage and deal sizes. For fundraising from limited partners, we observed a range of 0.5-2% of the amount raised as a commission.

- Carry: Depending on the exposure across your investment practice or portfolio, you might assign fund carry points to the venture partner. We have seen a range from 0.5-2% of fund carry as a benchmark. This is the percentage of the typical 20% carry a fund would earn. If your venture partner is predominantly contributing to individual transactions, you can assign deal-by-deal carry points. Data was spotty on this one, and from speaking with a number of funds, we learned that this number varies quite a lot and depends on the venture partner's own investment in the deal.

- Exposure (PR, brand and network): For someone in transition, being associated with your fund’s brand can be a highly effective tool to create new career pathways. This can take the form of representing the fund at relevant industry events or in local hubs. The same way your venture partner might introduce you to relevant founders in a new community, you might put her in touch with a relevant investor for her new pre-seed fund.

- Learning and sense of direction: For VPs in transition, setting aside some time to kick ideas around or provide coaching from a senior partner around the venture partner’s next move might be the most helpful thing you can do.

Again, a lot of the compensation is pegged to the venture partners willingness to put their own money into the VC fund or into the specific deal at the table.

Time for some dos and don’ts

Here are some additional rules of thumb for VCs to consider when hiring venture partners.

DO give those partners who are in a transition the security they need to figure things out, as well as direction throughout the program. Spend a good amount of time in the kickoff understanding why they are taking the role, and try to optimize for that. Remember: a retainer from a fund is not usually your most valuable asset! More valuable are exposure, brand, learning and network. In these cases I like to say:

DON’T hire anyone who is interested only in a retainer and income security. Wait until they have figured out what is important to them (be it exposure, brand, learning, network, transition or upside through carry). Otherwise, you are at risk of disincentivizing transition partners to move on.

DO manage expectations transparently: will this lead to a more formalized role in the fund? What kind of decisions will the venture partner be allowed to take? What kind of budget can they work with? To what degree can they speak on behalf of the fund?

DON’T go in without assessing potential conflicts of interest. For example, can you hire someone who is with another fund?

DO align incentives through fund carry and co-investment bonuses. In our discussions, we learned that these incentive instruments helped fund managers to get (professional) venture partners into long-term commitments.

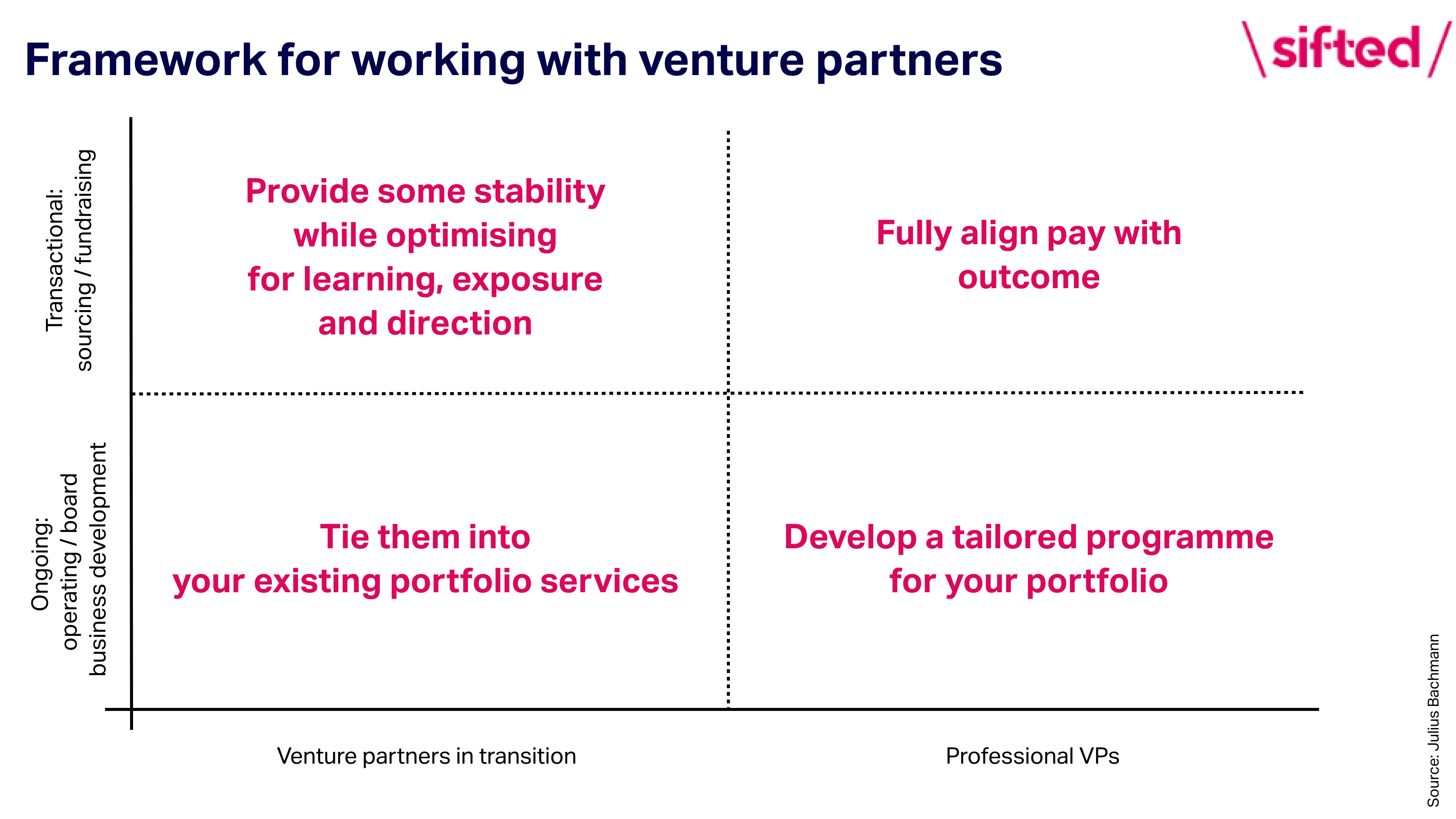

A framework for working with venture partners

Hiring venture partners to your fund can be a great asset for your investment team and your portfolio. The key question is: How can you design an engagement model with those professionals so that incentives are aligned for the areas where those venture partners can add most value?

I will leave you with a framework that sums up the different kinds of venture partners and how to think about aligning pay with the priorities of each party:

Julius Bachmann is an executive coach based in Berlin working with three VC firms: Entrepreneur First, Joyance Partners and Backed VC. He began his career at Earlybird and Redstone.