German digital bank N26 may have just hit 7m customers, but its 2019 accounts suggest it's paying a high price for popularity.

N26 saw global operational losses grow to €217m in 2019, a 210% hike on the previous year. This is despite having doubled its revenues from €43m to €100m in 2019, according to a press briefing.

The company, which is six years old, posted heavy expansion costs including to the UK, where it eventually pulled out of early last year after spending €26.9m.

In an interview with The Handelsblatt , N26 chief executive Valentin Stalf explained the losses were a product of "investment", as well as growing the team to over 1500.

Stalf also suggested profitability was "in sight" for the end of this year, with 2020 proving slightly more positive (unofficially recording €110m in losses).

Ironically, this reduction in losses also comes alongside slowed customer growth. In 2020, N26 onboarded 2m users; down from 3m in 2019 — following a drop in marketing spend amid coronavirus.

The company now has ambitions to bring on 100m customers worldwide. Currently, its user base is heavily concentrated in its native Germany and France, making slow inroads in the US.

A trend

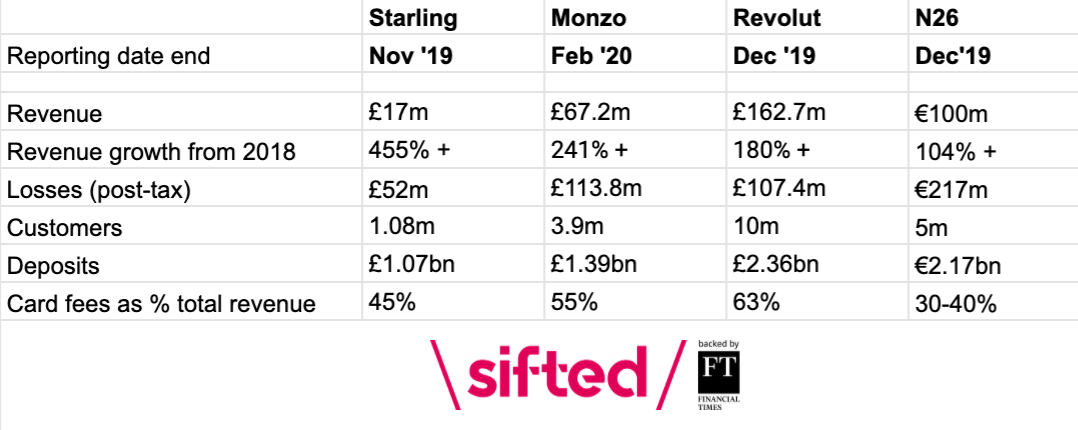

N26's stark losses come as no surprise following the 2019 accounts of fellow neobanks Revolut, Starling, and Monzo, which were published last summer. All saw post-tax losses grow to between £52m and £113m.

The results come as a surly reality check for the sector, which has attracted millions of consumer users but seem to be struggling to control costs. Digital banks also still seem to be grappling with how to seriously monetise current accounts — often dubbed the “low hanging fruit” of banking — and it remains to be seen whether their business models can confidently ride out Covid-19 or deliver the multibillion dollar valuations.

Still, there are some signs of a turning tide.

Fintech analyst Lex Sokolin says Revolut’s 2019 revenues put it confidently in the lead among the neobanks. Speaking on the Rebank podcast, he said: “£160m in revenue… that number feels quite large and it does feel to some extent like a victory of building a large scalable business.”

N26 looking ahead

One positive for N26 is it has the most diversified revenue stream among its peers.

Transaction fees (known as interchange) still makes up an important part of all digital banks' businesses, but it now only contributes 30-40% of N26's income.

Card transactions is a piecemeal income source that is ultimately pegged to how much people spend, meaning N26 may have proven more resilient during the lockdown period as card use dropped.

Instead, N26 has built up a good premium offering, charging an average of €9 for accounts and added services. Subscription fees made up 30-40% of the company's revenues, while between 20-40% came from its lending division and partner offerings.

To date, N26 has raised over €800m, including from Peter Thiel's fund Valar Ventures and China's Tencent.

It will be hoping to put this war chest to use in the US this year (it has countless job openings in the region advertised on LinkedIn). It also scooped a bank licence in Brazil.

The company also told CNBC it is considering acquiring other fintechs, having recently brought on a new CFO with experience taking startups public.

Nonetheless, N26 will need to keep on an eye on the German regulator, Bafin. Reports this week suggested that Bafin is looking at tightening control over banks like N26 in response to the Wirecard debacle.

It has also seen staff in Germany unionise after opposition over the summer.

Note: N26 will officially file its 2019 accounts in the next few weeks. German media outlet The Handelsblatt first reported the figures, before a press outline was sent to Sifted.