What’s the world’s largest charitable foundation? Nope, its not the Bill and Melinda Gates Foundation. Not even the Wellcome Trust.

It’s Novo Nordisk Foundation, a $65bn endowment headquartered in Copenhagen.

Yes, it is bigger than the Gates Foundation in terms of assets.

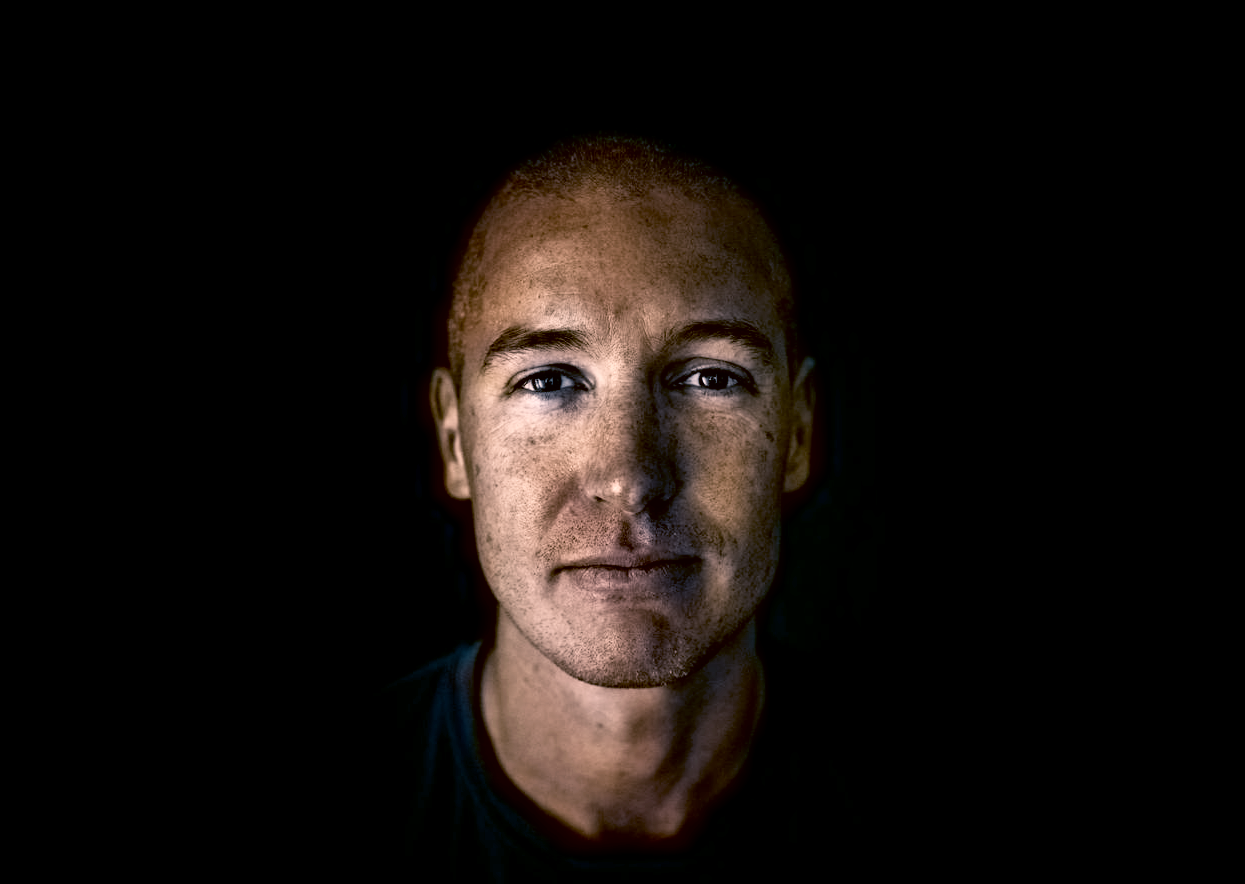

“Yes, it is bigger than the Gates Foundation in terms of assets,” says Kasim Kutay, the chief of Novo Holdings, the investment fund that manages the assets and investments for the foundation.

“The reason is that we are an enterprise foundation that both owns companies and at the same time also has a charitable purpose. However, Gates Foundation is by far the biggest foundation in the world when it comes to grant giving with a five times higher activity level than us.”

Novo Nordisk Foundation doesn’t get quite the headlines that the Gates Foundation has. Maybe it is a Danish "Jante law” thing — a Nordic cultural convention that discourages individual ambition and sticking out from the crowd.

The Novo Nordisk Foundation gave out some $800m in grants last year to scientific, social and humanitarian purposes. One of its recent focuses has been, for example, funding research into antimicrobial resistance, an area that is underfunded but which could pose a greater threat to humanity than Covid-19. It also supports researchers with wild and crazy ideas through its NERD (New Exploratory Research and Discovery) research programme.

The company that makes sure that the Foundation has money to spend is Novo Holdings, which ranks among the world’s most active life sciences investors.

If you are a life sciences company, Novo Holdings is likely to appear on your cap table at some point.

Half of the Foundation’s funding comes from Novo Nordisk, one of the leading diabetes companies. Novo Nordisk is something of a controversial company — together with Eli Lilly and Sanofi it has been under fire for raising the price of insulin over the past decade. But the profits do get ploughed back into research aimed at benefiting society.

The other half comes from the investments of Novo Holdings. Look at a list of VC investments in any given week and you see Novo Holdings crop up, over and over again on the list of backers. The fund made 33 new investments and 65 follow-on investments in life sciences companies investments in the last year

The returns are pretty robust — averaging at 13% over the last 10 years (against about average stock market returns of about 10% for the same period). In fact, last year and in 2017 the investment arm made more money than the pharmaceuticals and biotech business.

If you are a life sciences company, Novo Holdings is likely to appear on your cap table at some point in your life cycle. But people still don’t know much about how this quiet mega-investor works. Sifted felt it was time to shed some light.

In a nutshell

Novo Holdings isn’t a corporate venture fund. It is actually the other way around — it is the controlling shareholder of Novo Nordisk, the pharmaceuticals company, and Novozymes, the bioindustrial company. Novo Holdings exists solely to make money for the Novo Nordisk Foundation. There’s no corporate strategy as such, the brief is just to get attractive returns (although there are a couple of things they don’t do, but we’ll get to that later).The life science investment part of Novo Holdings actually has four parts to it, covering all the stages of investment. There’s a total of about $25bn in the investment portfolio, actively invested.Novo Seeds — This part of the operation invests in very early-stage biotech companies in the Nordic region. They have a portfolio of some 30 companies, and one of these, Galeto, recently became the first to reach IPO stage.Novo Ventures — which has invested in companies like Nevro, the maker of treatments for chronic back pain treatment and Procept surgical robots — is having a blistering year.“In a typical year it would invest $350-$400m, but in 2018 it invested $500m and this year it will be close to $600m,” says Kutay.Novo Growth takes bigger stakes in revenue-generating, growth-stage companies. It recently invested in Oxford Biomedica and Exscientia, as well as The Protein Brewery, a Dutch developer of sustainable, fermented protein.Principal Investments is the company’s private equity arm, which makes $100m+ sized investments.

Is there a secret formula for how you invest?

Kutay: There are really just two things that are special about the team.

One is that we have incredible continuity, many of the original team from the early 2000s are still there. That counts for a lot, it is a team that has grown up together, made mistakes together and had successes together. They have a good sense of what they are good at and what they aren’t good at.

A lot of investment is about knowing what to avoid.

A lot of investment is about knowing what to avoid based on your particular strengths. For example, we rarely invest in medtech ventures that don’t already have FDA approval. We do that all the time on the biotech side.

The next thing is our compensation system — we don’t have a formulaic carry system but a bonus structure that looks beyond just returns and values teamwork. Because of that, there is a team player aspect that is very special. The whole is greater than the sum of the parts. We don’t have deals that belong to a particular partner; the team is accountable.

Third, is a life science heritage and network that is very valuable. Finally, our long-term investment approach; we are an evergreen fund with one investor that is focused on long-term returns. For many companies that makes us an ideal partner.

You took over an established team in 2016 — how much did you change?

We changed the name from Novo A/S to Novo Holdings to stop confusion with Novo Nordisk — and changed the investment strategy to make sure we built on and enhanced our leadership in life sciences. We founded Novo Growth and Principal Investments, and built a presence in the US and Asia.

Novo Ventures moved into healthcare IT, investing in MD Live which is the second biggest telemedicine company in the US after Teledoc.

What will you NOT invest in?

We never put ourselves in conflict with Novo Nordisk. We don’t invest in diabetes or obesity. We avoid investments that would be in conflict and if there is any doubt we pick up the phone. It does mean walking away from deals sometimes.

The same goes for Novozyme, which is the leading bio-industrial company. We don’t invest in bio-industrial companies that would be in conflict.

The European biotech market has lagged behind the US for many years. Is it catching up now?

Around 80% of our venture portfolio is US-based. But we are growing more optimistic about Europe. More and more US funds are coming to invest in Europe because they find the valuations more reasonable. It is also a testament to the number of companies coming through that are of higher quality.

The number of investable assets is not as high as in the US but I think the quality of deal flow is getting better.

At one stage there were a lot of companies coming to market that are not of the right quality. The British Biotech disaster was infamous in the 1990s (the company was the first British biotech company to list on the stock market and was briefly valued at $2.5bn before collapsing when it was discovered its lead development drugs didn’t work). The market completely died after that. A lot of failures held the market back.

It really angers me to see the flood of companies going to Nasdaq to list.

Europe is still hampered by a lack of exits for companies. It really angers me to see the flood of companies going to Nasdaq to list. Everyone is chasing a US listing. It is a real shame.

For example we took Orphazyme public in Denmark but the big prize was a later listing in the US. Where companies list does make a difference. If you want a deep market, listings are a contributor to that.

The other thing that holds Europe back is management. Having a great CEO and management team is as important as the science. In many European countries, the gene pool is smaller to hire from. Denmark has some 6.5m people so the pool of CEOs is naturally smaller than in the US. And hiring talent from abroad is not that straightforward. Going from Copenhagen to Frankfurt is not as easy as going from Boston to California. And moving from a big city like Paris to a smaller one like Rotterdam can be even more complicated.

2020 has seen a record number of biotech investments. Is this a bubble?

It is and it isn’t. We are riding an incredible wave of innovation that started in 2011/12. 10 years ago there were a lot of jokes about the lack of productivity in biotech but now we are seeing incredible progress in areas like cell and gene therapy. We are still at the early stage of what can be done there.

We are riding an incredible wave of innovation that started in 2011/12.

So are things a little frothy? Yes. Are some things valued at $200m that should only be worth $150m? Yes. But I think there is substance to justify a large part of it. This trend still has many years to run.