A flurry of recruitment tech startups — businesses that help prospective candidates find jobs online — have popped up in recent years, and are beginning to raise significant amounts of cash.

It’s no wonder. Since much of the world has transitioned to remote work, a global talent pool has opened up, enabling companies to hire across borders. The freelancer economy has boomed in recent years — in the second half of 2021, 13% of people of working age in Europe were self-employed — leading to a growth in platforms linking freelancers to temporary assignments.

Not only that, but tech talent has been harder to recruit than ever before, with many having to turn to specialists to help them dig out the best hires.

Recruitment tech comes in many forms, including job platforms for students and graduates, freelance marketplaces, staffing agencies for manual workers and platforms focused on hiring tech talent for startups, among many others.

Leading the pack — at least in terms of funding — is Zenjob, a Berlin-based digital staffing marketplace offering temporary work opportunities. It’s raised $107m since its launch in 2015, including its recent Series D round of €45m, from investors such as Acton Capital and Atlantic Labs.

We’ve collected data from some of the European players to find out where the recruitment tech market is now and where it’s heading.

Incumbents and newcomers

The oldest recruitment techs in Europe — many of which are the digital version of job boards — emerged in 2015. These include Zenjob, Honeypot — a Berlin-based developer-focused job platform which was acquired by New Work SE (formerly XING) for €22m in 2019 — and Talent.io, a tech hiring platform headquartered in Paris.

HeyJobs, a Berlin-based talent acquisition platform, was founded a year later and took a much broader approach to recruitment in response to changing labour demographics in Europe. European employers are facing a dearth of talent across all industries as Baby Boomers retire. HeyJobs helps companies recruit essential talent across 100 different job types such as lorry drivers, nurses and electricians.

More recent additions to the recruit-tech cohort are going in a different direction and giving recruiters more tools. Circular, a Madrid-based platform founded in 2019, for example, allows recruiters to share candidates. Screenloop, a so-called hiring intelligence platform, helps companies source candidates, analyse interviews and gather data and feedback to shape onboarding plans.

Others aim to put the power back into the hands of candidates. Hackajob, for example, operates a private tech careers marketplace where companies can pitch candidates on potential opportunities, with all information including salary and tech stack shown up front.

Nicole Lai, an investor at Cherry Ventures focusing on HR techs, says that recruit-techs are increasingly moving from being “traditional job boards” to integrating other types of HR tools into their platforms, like candidate selection tools or software that can pull data points and feedback from interviews which is fed back to HR teams.

“So companies can look at the results and say well, out of 10 interactions, seven of them went really well because of XYZ reasons, or 50% of the interactions weren’t great because of a certain question we asked; let’s remove it,” Lai explains.

London-based platform DirectlyApply, in addition to being a job discovery platform, includes other features such as a CV builder, diversity and inclusion checker and salary comparison tools.

Above are the recruitment techs which connect companies with prospective candidates. Honeypot has had 10,000 companies reach out to them to ask to join the platform, but they do not give access to every company as "quality counts more than quantity on the client-side as well as on the tech talent side," said a spokesperson.

YoungOnes, a Dutch company matching freelancers with temporary jobs, has the most users (325,000) signed up to its platform.

Which markets are they trying to win?

A large proportion of the recruitment techs surveyed by Sifted are based in the UK and Germany, with a smattering in the Netherlands and the Nordics. Many have plans to expand further into Europe, while others are looking to the US and Australia as future markets.

Talent.io, which specialises in tech roles such as software engineers and CTOs, has expanded to 11 cities in five countries: France, Germany, the UK, the Netherlands and Belgium. The company is now expanding its reach to onboard remote candidates and freelancers across Europe.

Meanwhile Jobvalley, a Cologne-based platform matching students with temporary work or career opportunities, is setting its sights on the Netherlands, Austria and Italy. So, why these markets?

Jobvalley’s CEO Eckhard Köhn says that the “Dutch economy and talents are very open to our services according to our research”. Austria is a neighbouring German-speaking market, so expanding there makes sense. And the Italian market, particularly in the north, is “just taking off”.

“Recently, other players in adjacent fields have started to invest significantly into Italian initiatives. It’s an ecosystem with its own rules — yet very attractive,” he adds.

DirectlyApply, meanwhile, is the only company surveyed to have expanded outside of Europe to the US and Canada.

Generally, says Thomas Lueke, partner at European early-stage VC firm Cherry Ventures,, markets such as the UK and Germany are popular because that’s where the big tech ecosystems are. “If you look at venture funding, it’s in all the core ecosystems in London, Berlin and the Nordics. I would expect those are also the areas where all these job boards that are geared towards tech recruiting are thriving.”

Who’s got the most cash?

Zenjob has raised the most cash out of all the recruit-techs we surveyed: $107m since its launch in 2015. The company is not yet profitable and is “fully committed to growth”, said a Zenjob spokesperson.

Next up is Cologne-based Jobvalley, which has raised €34m since its founding in 2008. Last year, the company turned over €113m in revenue, and has projected 20% year-on-year growth. It is unlikely Jobvalley will raise much more, as Köhn says the company has been “operating profitably for three consecutive years and funds its growth from working capital and profits”. Köhn says he is a “strong believer of this sustainable approach.”

Many of Europe’s prominent investors have backed one of the startups, including LocalGlobe, Point Nine and Notion Capital.

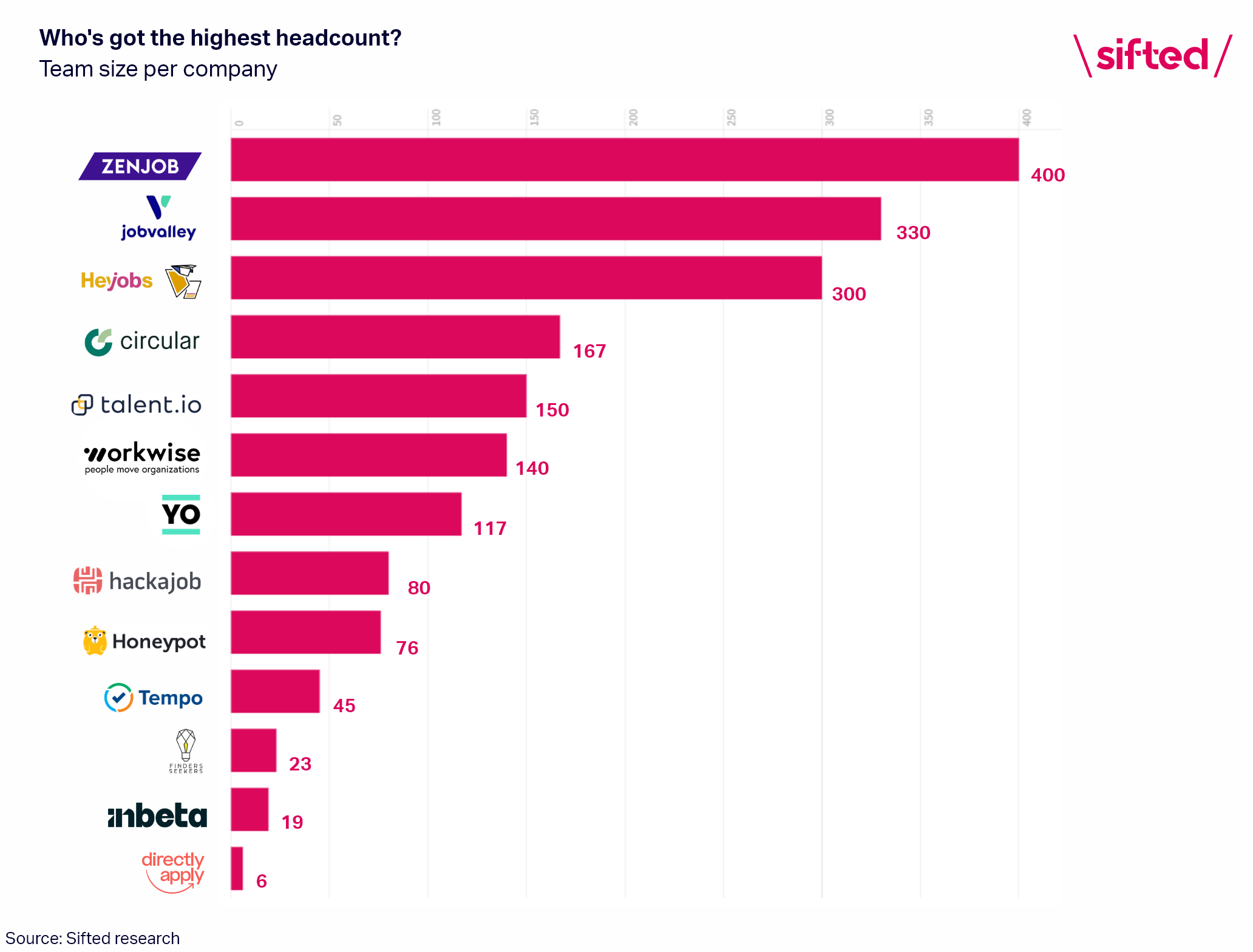

How many staff do recruitment techs themselves have?

Unsurprisingly, Zenjob has the highest headcount, followed by fellow Germans Jobvalley and HeyJobs.

Heyjobs is currently expanding to Austria and plans to grow its headcount from 300 to 500 employees by the end of 2022.

What’s next for the market?

Lueke says that he sees three major subsectors within recruitment tech right now: job boards, tech-enabled hiring agencies (classic headhunters, executive recruiters and more vertical-specific agencies like Honeypot) and talent referral platforms.

Talent referral platforms are ways of pooling talent which can be shared with others. For example, Berlin-based Sompani offers a private platform where VCs and their portfolio companies can share candidates.

Areas like referral hiring — where internal employees or external sources recommend candidates to companies — haven’t been cracked yet, says Lueke. “It is important for I would say most tech startups, but there's no particular process or tooling or software around it just yet.”

Lueke is also excited by any platform that creates new talent supply — such as a company that connects well-trained developers in Africa to western companies. Or a platform that “allows a talent pool that previously hasn’t been networked to be able to network, like a LinkedIn for verticals”.

“There are highly trained, highly skilled blue-collar workers that identify around being electricians for example. If you can network them and make that pool of talent accessible to hiring companies, I think that could be interesting,” says Lueke.

Lai from Cherry Ventures adds that tools that help HR teams “increase their brand strength and improve the talent experience in a very data-driven way” could make for an interesting new category in recruit-tech.

Companies to watch in this area, she says, include Talenthub, a platform based in Copenhagen, Denmark. TalentHub offers job postings and recruiter services, but it also offers companies data to improve the candidate experience throughout the recruitment process — the latter of which is more important than ever in a challenging hiring environment.

Correction: Talenthub is not based in The Netherlands but in Copenhagen, Denmark.