Founders are not short of options when it comes to raising a seed funding round in Europe. There are now over 2,500 seed-stage investors based on the continent — and plenty more global VCs willing to take a punt on a European startup.

Over 2,200 European firms received seed stage investment in 2020, totalling approximately $3.7bn in funding.

But which of the many VC firms out there should founders put high on their list to pitch to for seed funding?

Data platform Dealroom has ranked Europe’s seed-stage investors based on the number of deals closed in 2020 (in Europe, Middle East and Africa) and how many unicorns are in their portfolios,categorised by “realised unicorns” (i.e. companies which were sold or went public at a valuation over $1bn), “unrealised unicorns” (i.e. private companies in their current portfolio which have a valuation of $1bn) or “future unicorns” (i.e. private companies in their current portfolio which are valued between $250m and $1bn and showing fast growth).

But, because the money is only one part of the equation, Sifted spoke to the VC firms to find out what else makes them stand out, and discovered what founders think of some of them on Landscape, the ‘Glassdoor’ for VCs.

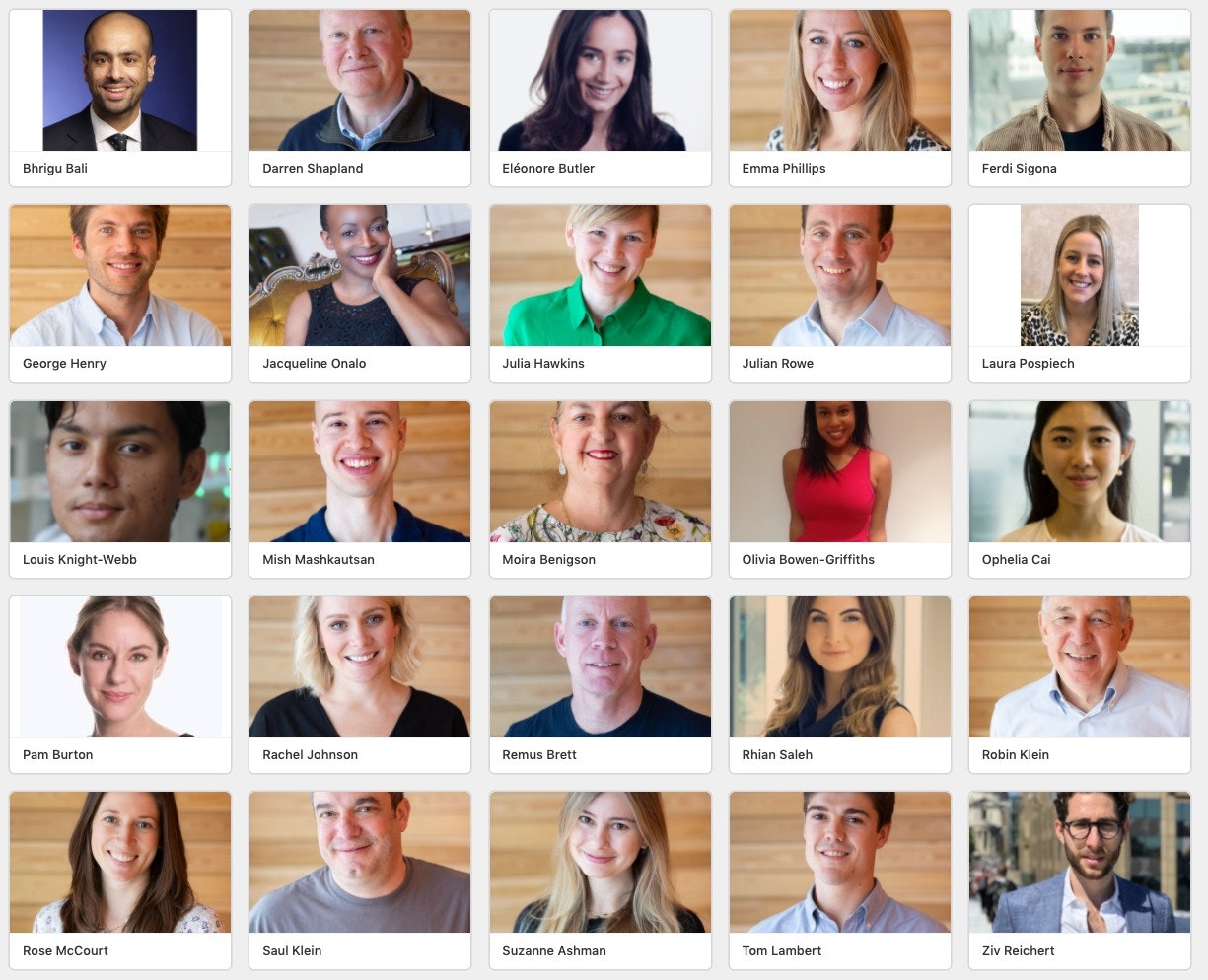

1/ LocalGlobe

Latest fund covering Europe: $115m (Jun 2019)

Focus: Europe; sector agnostic (cheque size $1-4m)

Deal count EMEA in 2020 (all stages): 28

Gender split of investment team: 78% men, 22% women; 52% men and 48% women in wider team

Number of EMEA unicorns: 6 (realised and unrealised); 16 (future)

Notable investments:

- Money transfer platform Wise (formerly TransferWise)

- Online car retailer Cazoo

- E-scooter startup Voi

What we say:

LocalGlobe has been one of the best known seed-stage investors in Europe since father and son duo Robin and Saul Klein kicked it off in 2015. Since then, it’s launched numerous funds, and invested in over 200 startups.

LocalGlobe doesn’t only dabble in seed investment. In 2019, it launched a new “breakout” fund called Latitude to invest in companies at Series B and is currently raising a second later-stage fund. The idea is that LocalGlobe can back companies at Series B without messing up the dynamics of its seed fund.

On sustainability and diversity, LocalGlobe has been working with transatlantic VC firm Beringea alongside numerous other funds to test an environment social governance (ESG) framework which covers various “routes of measurement” like reduction of carbon emissions and gender pay gap.

What the founders say:

“We got close to a deal with LocalGlobe but didn’t quite get there in the end. However, Remus, Brett and Michelle you were an absolute pleasure to deal with. And even though they didn’t fund us, we’ve stayed in touch and they’ve provided me with really helpful advice and introductions. Honest, friendly and down to earth to deal with.” (non-portfolio, via Landscape)

2/ Entrée Capital

Latest fund covering Europe: $100m (April 2020)

Focus: Sector agnostic; Israel, Europe and the US; (cheque size $500k- 5m)

Deal count EMEA in 2020 (all stages): 26

Gender split of Europe-based investment team: 47% female

Number of EMEA unicorns: 7 (realised and unrealised); 2 (future)

Notable investments:

What we say:

Founded in 2010 with offices in London, Israel and the US, Entree’s most recent sixth fund for early-stage startups landed at the height of Europe’s first wave of coronavirus lockdowns. With the fund, it’s placed a large focus on deeptech including quantum computing, VR and AR, AI, and the digital health and fintech sectors.

Over the past two years, 37% of the team’s investments were into minority and female founder-led startups, according to Entree’s cofounder and managing partner Avi Eyal.

3/ Point Nine Capital

Latest fund covering Europe: €100m (Nov 2020)

Focus: Global; B2B SaaS/marketplaces; (cheque size$/€0.5-3m)

Deal count EMEA in 2020 (all stages): 11

Gender split of investment team: 4 men, 2 women

Number of EMEA unicorns: 5 (realised and unrealised); 7 (future)

Notable investments:

- Food ordering platform DeliveryHero

- E-mobility startup Tier

- Cargo booking platform Cargo.one

What we say:

This Berlin-based VC has been on the hunt for B2B SaaS startups across the globe for over a decade, and has built up a portfolio of over 150 companies in 30 countries. Its founding partners, Pawel Chudzinski and Christoph Janz, are well-respected by fellow investors and founders alike.

Point Nine is also known for its sense of humour — last year it raised a new fund of €99,999,999.99 — and promoted Ricardo Sequerra Amram and Louis Coppey to partners.

It’s a hands-on investor and encourages portfolio companies — the ‘P9 Family’ — to help each other out too. One of its initiatives, Family Summit, brings together its entire portfolio and some non-portfolio companies. It also has a blog, Point Nine Land, where P9 Family members publish their musings on SaaS, marketplaces, startups, VC, and more.

Point Nine is involved with Included VC, a scheme to help people from diverse and underrepresented backgrounds get into VC. Its Point Nine partners include associate Julia Morrongiello and partner Christoph Janz.

4/ Seedcamp

Latest fund covering Europe: £78m (Nov 2020)

Focus: Sector-agnostic; pan-European; pre-seed (£150-200k) to seed (£200k-500k)

Deal count EMEA in 2020 (all stages): 45

Gender split of investment team: 7 men, 1 woman

Number of EMEA unicorns: 5 (realised and unrealised); 3 (future)

Notable investments:

What we say:

Since launching in 2007, Seedcamp has built up quite the portfolio. It currently counts five unicorns in its herd — Wise (TransferWise), Revolut, wefox, UiPath and Hopin — and has an unrivalled network in Europe.

The so-called ‘Seedcamp Nation’ — the firm’s community of founders, portfolio company employees and co-investors — is now pretty giant, and means startups backed by Seedcamp get easy access to early customers, advisors and potential employees as part of the package.

Seedcamp’s investment process isn’t typical — six times per year the team runs investment sprints leading up to an investment forum. Companies fill in a form via Seedcamp’s website or are referred by people in its network. (Just 10% of applications don’t have some kind of connection to Seedcamp already.) Someone from the investment team speaks to each company, a couple of people review each deal and then the most promising startups present to Seedcamp — and a relevant selection of its LPs — at an investment forum.

Seedcamp has been partnered with the VC internship scheme Included VC for the last two years and contributes regularly to other initiatives in the ecosystem such as Diversity VC and Female Founder Office Hours.

What the founders say:

“Great first cheque. Awesome network.” (portfolio, via Landscape)

“Replied in 12 days, didn’t invest, received a cold email with no feedback but they were open to be approached in the future.” (non-portfolio, via Landscape)

5/ Mangrove Capital Partners

Latest fund covering Europe: €200m (July 2017)

Focus: Sector agnostic; Europe and Israel (€500k-2m)

Deal count EMEA in 2020 (all stages): 8

Gender split of investment team: 75% men, 25% women

Number of EMEA unicorns: 5 (realised and unrealised); 3 (future)

Notable investments:

- Messaging service Skype

- Website builder Wix

- Brand protection startup Red Points

What we say:

Mangrove has two offices in Luxembourg and Tel Aviv, has been going for over two decades and has opened five funds. It was an early backer of a few European and American tech unicorns like Skype, Wix, WalkMe and K Health.

“We invest in unusual, unproven or unfavoured technology that can disrupt industries,” says Mark Tluszcz, CEO at Mangrove Capital Partners. “People often look at us like we are crazy when we tell them our latest investment.”

In 2016, Mangrove launched EasyVC (formerly known as European Female Founders), an initiative which supports female entrepreneurs and promotes diversity in the tech ecosystem through meetups and other events.

Its investment team shared some decent diversity numbers with Sifted — a third of its companies are led by founders from minority groups and of the 5,000 employees its portfolio companies has, 51% are female.

6/ Cherry Ventures

Latest fund covering Europe: €175m (Jun 2019)

Focus: Sector agnostic; Europe (€300k-3m)

Deal count EMEA in 2020 (all stages): 28

Gender split of investment team: 7 men and 4 women in investment team; 2 men and 6 women in wider team

Number of EMEA unicorns: 4 (realised and unrealised); 5 (future)

Notable investments:

- Bus company Flixbus

- Vertical farming startup Infarm

- Online tour booking platform TourRadar

- Digital automotive platform Auto1 (exited)

What we say:

Cherry Ventures is a pan-European early venture firm based in Berlin, with investment operations in London, Paris and Stockholm. It makes approximately 10 investments per year and participates in follow-on rounds. Unicorns in its portfolio include Auto1 Group, FlixBus, and flaschenpost.

In 2020, Cherry also snapped up Sophia Bendz, formerly a partner at Atomico and one of Europe’s best-known angel investors. She joined as a partner and focuses on seed-stage and Nordic investments.

Internally, the team has established a diversity and inclusion taskforce to improve the range of its hiring and deal flow. According to Bendz, there are a few upcoming diversity initiatives that the team at Cherry have been working on, such as a female-focused angel fund.

What the founders say:

“Overall a professional fund but they asked for a lot of information without giving a term sheet. Business plan, very detailed Q&A etc.” (non-portfolio)

7/ SV Angel

Latest fund covering Europe: $53m (Nov 2016)

Focus: Global; software-focused companies spanning consumer and enterprise; US and Europe; ($25k-100k)

Deal count EMEA in 2020 (all stages): 2

Gender split of investment team:

Number of EMEA unicorns: 4 (realised and unrealised); 2 (future)

Notable investments:

- Payments platform GoCardless

- Money transfer platform TransferWise (Wise)

- Online identity verification startup Veriff

What we say:

This Silicon Valley headquartered VC has been investing in software-focused seed-stage startups across the globe for 25 years.

In 2018, the VC scaled back its team and is focusing on raising smaller $25k-100k funding rounds, with its father and son comanaging duo Ron and Topher Conway operating as angel investors.

The VC firm is involved with a few initiatives, such as sf.citi, a non-profit organisation working to support tech policy solutions in the San Francisco area and Pledge 1%, a philanthropy programme where startups give equity, product, profit, time or a mix to charity.

Ron Conway works with other early-stage US VCs like Slauson & Co, to fight against racial inequality and support non-white founders.

8/ boldstart Ventures (US)

Latest fund covering Europe: $75m (Feb 2021)

Focus: US, Canada, Europe, SaaS (enterprise software) ($1-1.5m)

Deal count EMEA in 2020 (all stages): 3

Gender split of investment team: 5 men, 4 women

Number of EMEA unicorns: 4 (realised and unrealised); 0 (future)

Notable investments:

- Music streaming service Spotify

- Security software company Snyk

What we say:

Back in 2010, New York-based VC boldstart Ventures launched its $1.5mm proof-of-concept fund. Now, the firm has recently announced its fifth flagship fund of $155m, along with a $75m vehicle specifically for breakout startups and boasts some big advisors on its board like Microsoft, Github and Stripe.

According to its website, startups in its portfolio get more beyond the investment, such as tips on how to monetise an open source project, when to hire your first account representatives, how to do long term pricing well and more.

9/ 500 Startups

Latest fund covering Europe: $66.5m (April 2020)

Focus: Global; consumer and internet startups

Deal count EMEA in 2020 (all stages): 28

Gender split of investment team: The 500 Startups team is 100+ staff across 20 different countries, with more than half people of colour and half women.

Number of EMEA unicorns: 3 (realised and unrealised); 2 (future)

Notable investments:

- Diabetes health app Second Nature

- Health test kit startup Thriva

- Personal savings assistant Plum

What we say:

500 Startups has invested in a hell of a lot of startups across the globe. Since its inception in Silicon Valley, the VC firm has backed over 2,300 companies across 75 countries via its five global funds and 15 thematic funds covering different markets and geographies. Its headcount is over 100 strong and the team operates globally across 20 countries.

Beyond providing seed capital, 500 Startups supports companies via its seed accelerator programmes which are focused on a range of topics like digital marketing, customer acquisition, and fundraising for pre-seed companies.

On diversity, 500 Startups launched its ‘500 Startups Unity and Inclusion Summit’ in 2016, which aims to create better opportunities for diverse founders and investors in VC. A year later, its founder Dave McClure resigned after sexual harassment claims were made towards him by several women.

10/ Hoxton Ventures

Latest fund covering Europe: $100m (June 2020)

Focus: Europe and the US; sector-agnostic; seed and Series A ($500k-$5m)

Deal count EMEA in 2020 (all stages): 11

Gender split of investment team: All male team

Number of EMEA unicorns: 3 (realised and unrealised); 2 (future)

Notable investments:

- Healthcare app Babylon Health

- Cybersecurity startup Darktrace

- Food delivery company Deliveroo

- Online tour booking platform TourRadar

What we say:

Based in London, the Hoxton team is small, with just three partners: Hussein Kanji, Rob Kniaz and Rob Ludwig.

While it’s the only all male team on this list, Hoxton says on its website that 25% of its portfolio companies are founded by women and 41% started by minorities. “As far as we know, we are the only venture firm in Europe to publish our diversity stats on our website,” Kanji tells Sifted.

It also has an impressive unicorn herd — its first $40m fund invested in food delivery giant Deliveroo, digital health company Babylon and cyber security firm Darktrace, all now valued at more than $1bn. 75% of its portfolio has also gone on to raise from leading US funds.

What the founders say:

"Hussein and Rob have been great for us. They got on board with our pitch very early and continue to be great supporters and advocates for our business. The really great thing about working with Hoxton is being able to talk openly about issues facing the business. Their advice is always considered and focused on the best solution for us." (founder, portfolio)

“Straightforward fundraising process, thoughtful board member, good intros to US VCs, enjoyable to work with” (founder, portfolio)

👉 Read: How to spend your seed funding