While most people’s attention is focused on finding solutions to solve one crisis, all hope is not lost for fixing the other crisis we’re living through.

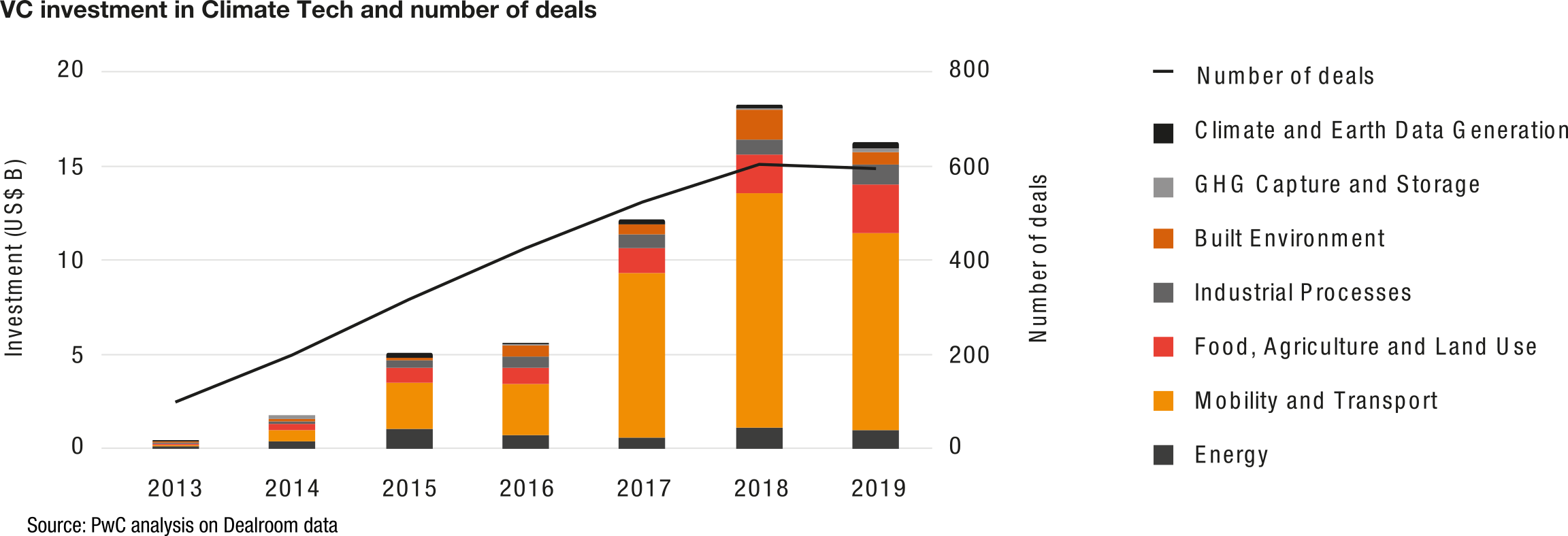

Venture capital investment into climate tech is growing at five times the average growth rate across all industries.

New research by PwC shows that, last year, $16.3bn was invested into climate tech (broadly defined as solutions that reduce greenhouse gas emissions) across the world. Back in 2013, that figure was at $418m.

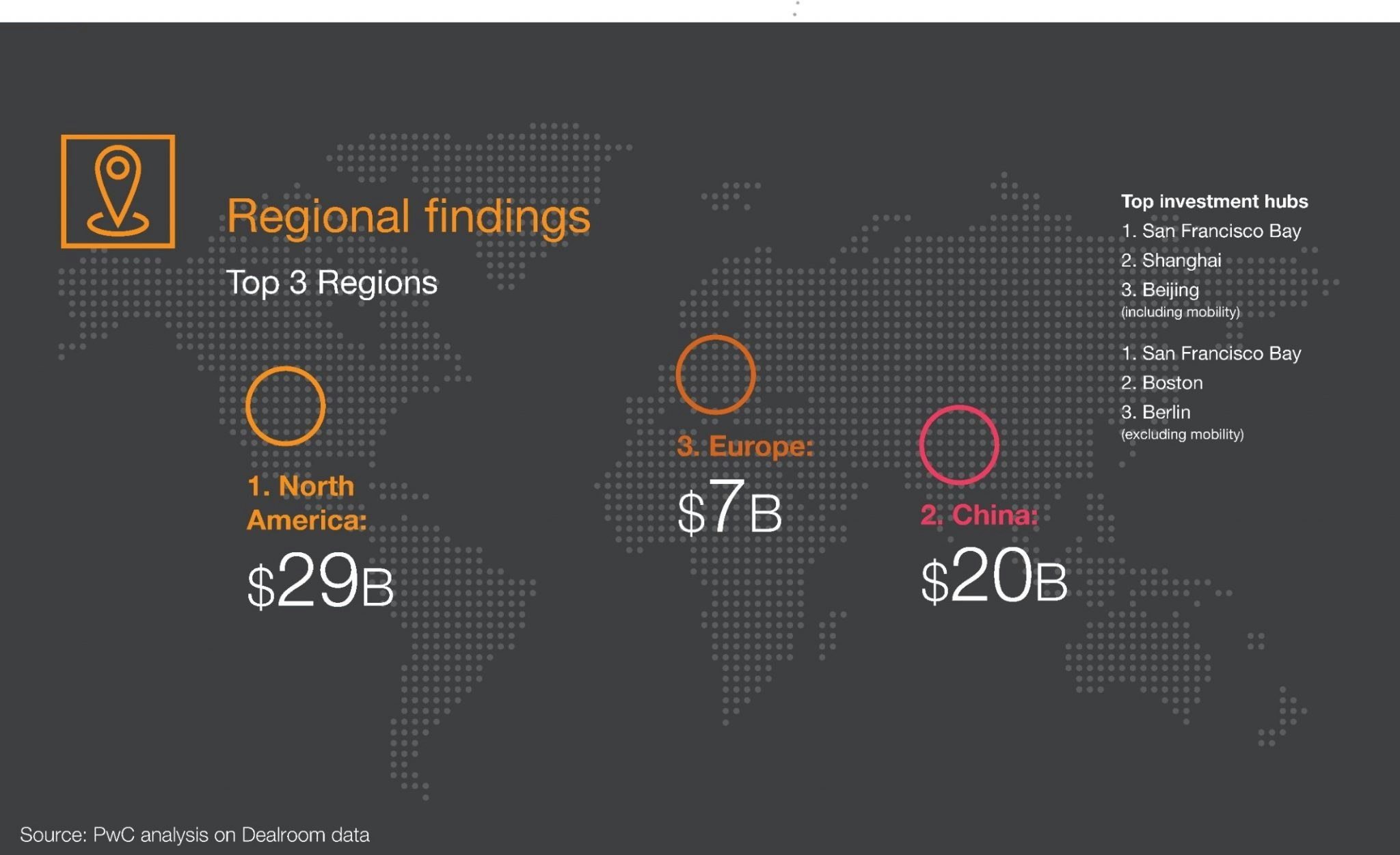

Investment in Europe is currently lagging behind other parts of the world — but catching up.

It’s heating up

Although the sector still only represents 6% of the VC market, VC investment into climate tech over the past seven years has grown three times faster than investment into the buzzy area of artificial intelligence, and grown five times faster than the average across all industries.

Azeem Azhar, author of the Exponential View newsletter and co-author of the PwC report, said the numbers were a sign that the climate tech market is maturing — but still at a very early stage.

“The ecosystem is still nascent, with key gaps in the depth and nature of funding available to founders and tricky structural hurdles for them to navigate as they scale their businesses.”

Many climate tech startups are working in sectors with high barriers to entry, like energy, heavy industry and transport. To get a leg up, many turn to corporate venture capital (CVC): 30% of the climate tech deals in mobility and transport included a CVC firm; while in energy 32% of capital came from CVCs.

Others, like Estonian graphene-based battery maker Skeleton, are partnering with far bigger organisations. Earlier this month, for example, Skeleton signed a €1bn letter of intent with a leading automotive manufacturer to bring its technology to market in 2023.

“The involvement of corporates will be key to the continued success of climate tech — both in terms of their net zero commitments driving demand for new solutions, and their investments into commercialising innovation. It’s not just the financial means they bring, but the commercial know-how, and industry knowledge to help startups navigate how to rapidly deploy and scale new innovations into the market,” comments Celine Herweijer, global leader in innovation and sustainability at PwC.

But it won’t just be corporates piling in to climate tech deals soon; it’s a huge opportunity for investors of all kinds. “Climate tech is a new frontier in venture investing for the 2020s,” adds Herweijer.

Europe is catching up

Nearly half of all VC investment into climate tech across the past seven years — $60bn in total — went to the US and Canadian markets ($29bn), with China receiving $20bn. Europe, however, received just $7bn of that total since 2013.

But there are indications that investment into climate tech in Europe is growing rapidly. A recent Tech Nation report showed that the amount of funding going into net zero companies in Europe — those which add no incremental greenhouse gases to the atmosphere — increased 129% between 2018 and 2019.

Europe also saw Pale Blue Dot, a new specialised climate tech VC firm based in Malmö, Sweden, launch in the middle of the pandemic earlier this year.

Several European startups working in the climate sector have secured funding recently. Earlier this month, Berlin-based vertical farming startup Infarm raised $170m in new investment, and Parisian company Seabubbles, which builds eco-friendly water taxis, continues to raise funds, now totalling £101m in total.

Outside of China and the US, PwC’s analysis shows that Berlin, London and Labège in southwestern France were the places seeing the highest investment into their climate tech companies.