Startup founders are after more than just funding from VCs — but the majority of them feel they don’t get it anyway.

That’s according to a new report by Forward Partners which surveys 500 founders and investors in the UK.

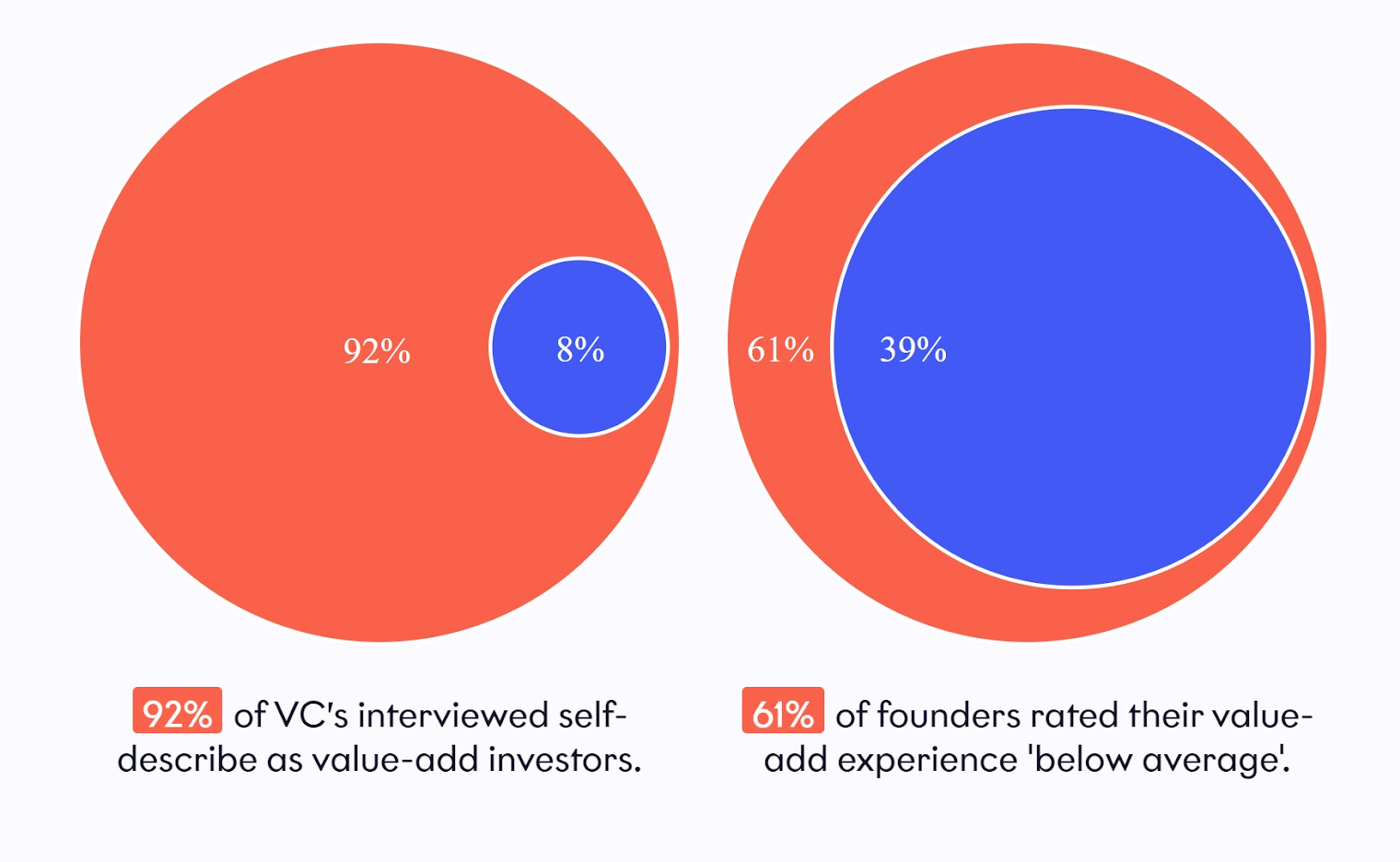

92% of VCs interviewed described themselves as value-add investors, but 61% of founders said the VCs they worked with brought less added value than they’d promised.

What is value-add?

VCs add value to a startup when they go beyond simply investing their cash.

That includes providing access to a network of partners, talent, investors or customers — something which helps with fundraising.

It also involves sharing knowledge about a sector, perhaps through other portfolio companies; giving companies access to PR and marketing resources; and to a larger in-house team that helps with things like product development or recruitment.

What’s going wrong?

Nearly half of the founders (47%) surveyed said they felt that VCs lacked enough industry-specific knowledge to properly add value to their business.

A lot of founders also expressed concern that value-added aspects of VC collaboration weren't goal orientated, so no one was clear what the desired results really were.

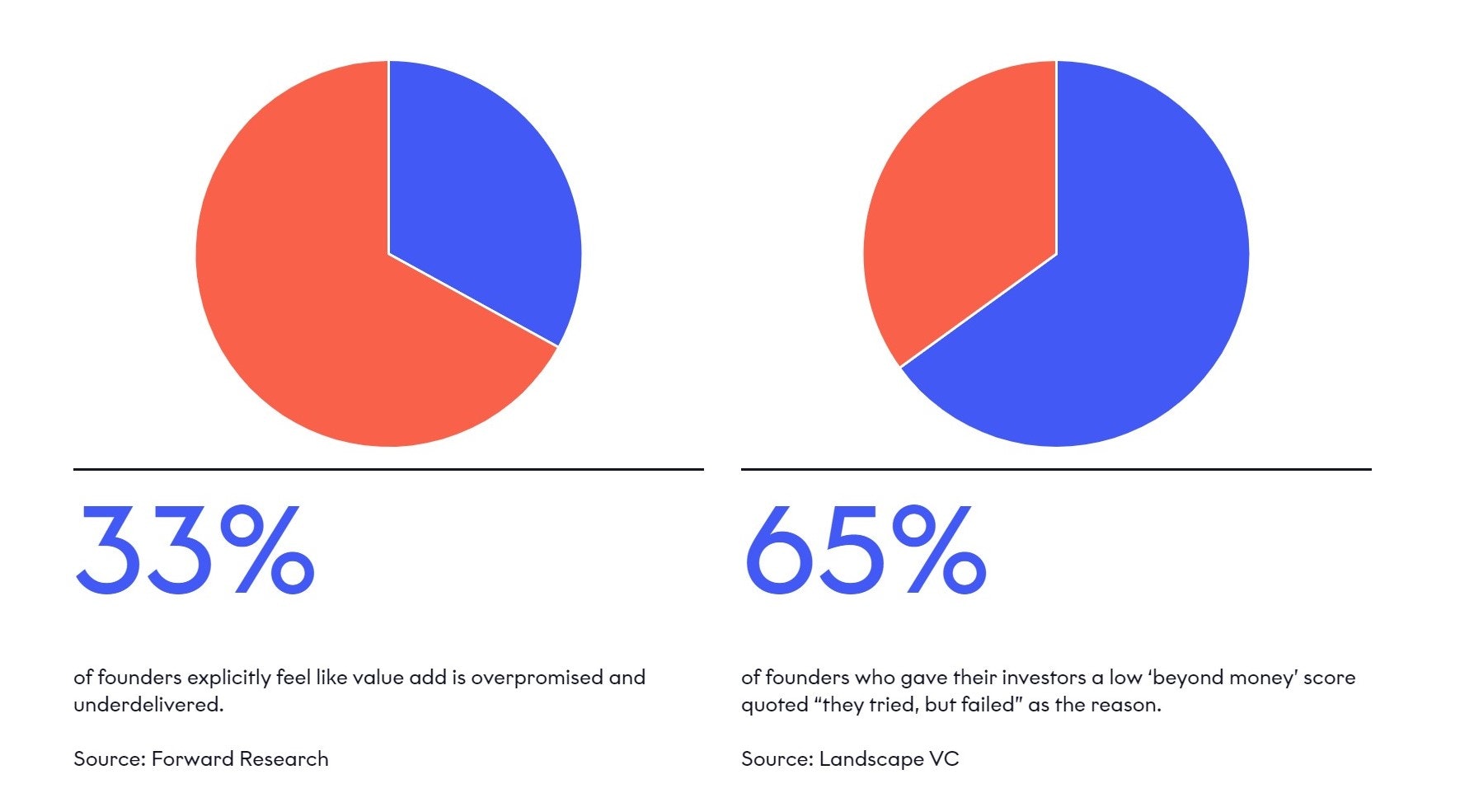

33% of founders said that they felt VCs simply weren’t honest about the expertise they could offer, and 65% said they felt VCs had tried but missed the mark on delivering things that went beyond cash investment.

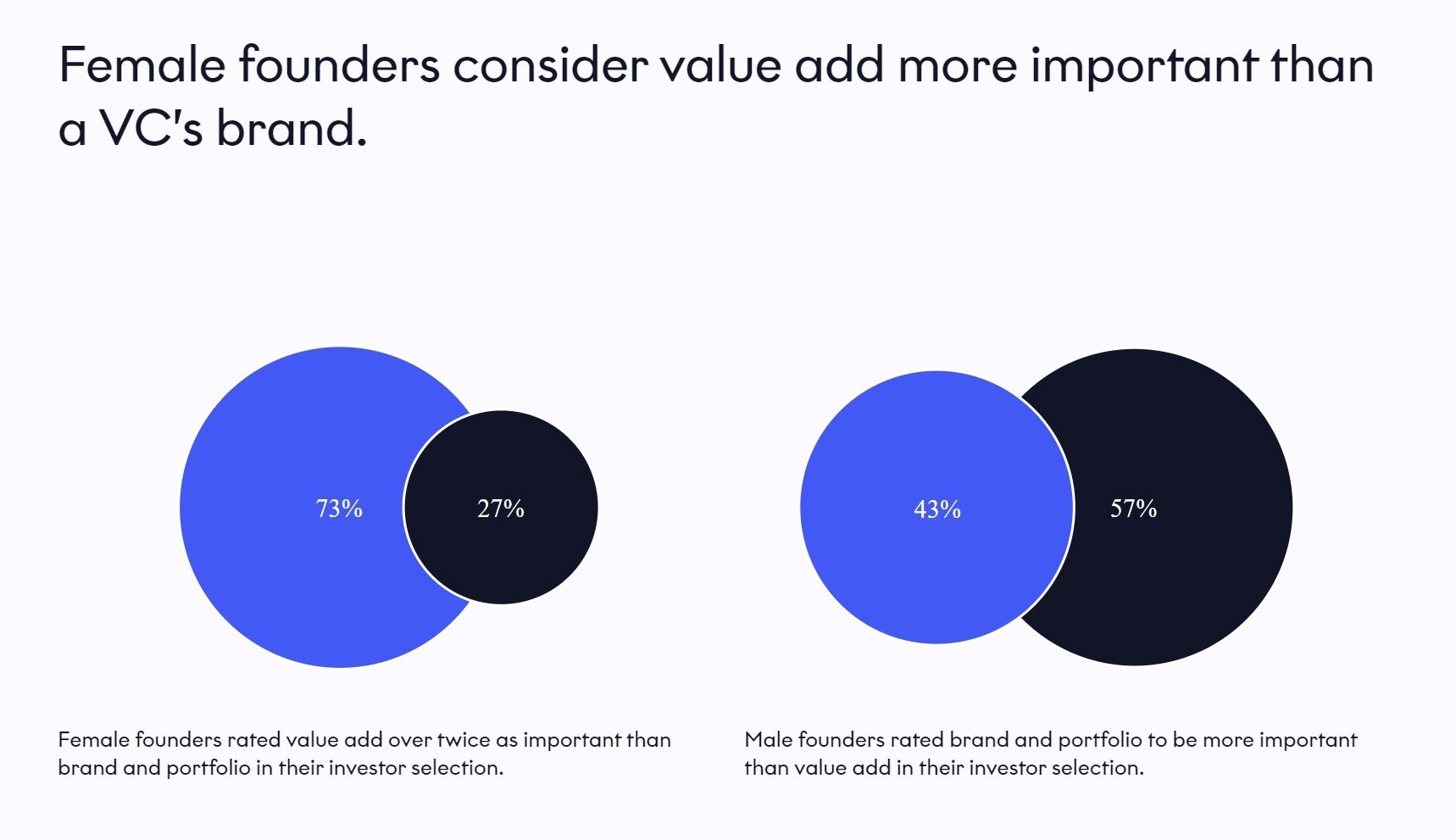

The report also, interestingly, found that female founders rated value-add as twice as important as the brand and portfolio of their selected investors, placing a much higher emphasis on it than their male counterparts did.

What do founders want?

One in three founders said that increased access to their investors’ networks and connections was what was missing. Others said that helping a startup to raise more funds is one of the most important things a VC can do.

“The biggest single thing that VC investors can do in a value added sense is help raise more cash,” said Jolyon Martin, head of business development at veterinary biotech PetMedix.

Specific industries have specific asks for VCs too.

Ecommerce founders tended to say they’re after knowledge sharing opportunities from their investors, such as sharing learnings between portfolio companies working within a specific industry. SaaS companies tended to value advice about growing their customer base, while B2B startups put support going to market as their biggest need from VCs.

Overall, founders said they were after more mentoring and emotional support — with 58% of post-seed founders saying it would contribute to their business growth.

This, combined with proper industry knowledge, unlocking your network for founders and being honest about the services you can offer, is what founders say they’re after.