Only a tiny circle of investors were early to the secret that was Sorare — now one of Europe’s biggest startups.

In just over a year, the Paris-based company has gone from a tiny seed round to a $4bn giant, seeking to become the home for non-fungible tokens (NFTs).

Sorare was dismissed as an obscure blockchain experiment by countless investors. But the VCs who jumped on the bandwagon early — including London’s Tiny VC and Seedcamp — have seen Sorare's valuation climb 636x in under two years. NFTs are enjoying a boom moment, leaving those who backed Sorare when it was worth a few million laughing all the way to the bank.

- New to crypto? Check out our guide (for members)

Perhaps Sorare and its backers just got lucky; perhaps it’s a short-lived success. Either way, the startup’s meteoric rise has helped bring digital assets into sharp focus for Europe's VCs.

Scared no more?

Mainstream VCs in Europe have undoubtedly picked up the pace of their crypto investment over the past 18 months.

Germany’s Speedinvest made its first crypto bet in Bitpanda last April, having passed on it at its seed in 2016; Dawn has backed Copper; Atomico has backed a scaling solution for ethereum called Starkware; and Augmentum made its crypto debut in Tesseract over the summer, followed by Gemini.

More recently, HV was a seed investor in Rvvup, betting on the London-based startup becoming the “third-generation” payments tool to bridge fintech and crypto. Balderton is also rumoured to have backed Ramp — Europe’s version of MoonPay. Scout programmes like Hedosophia’s have also quietly made crypto bids in recent months.

The market cap of crypto assets worldwide is now at $2.5tn (gold is at $10tn)… The temperature [among VCs] feels very strong

“We’re at that tipping point [in Europe] where most VCs have accepted that crypto is here to stay,” says Itamar Lesuisse, the CEO of Argent, a decentralised finance (DeFi) wallet for consumers.

“100% a lot of them are warming up... That has changed drastically from 18 months ago.”

In fact, Lesuisse says Argent’s upcoming Series A will be led by a mainstream European VC — although he declined to confirm which.

David Nunn, founder of Rvvup, has also witnessed mainstream VCs warming up to crypto. After announcing his startup plans on LinkedIn, he says he got inbounds from 22 serious European funds — including bank venture arms.

“[These funds] definitely seem to be awake to the fact that crypto is happening,” Nunn tells Sifted. “They’re just seeing the numbers, which are pretty explosive. The market cap of crypto assets worldwide is now at $2.5tn (gold is at $10tn)… The temperature [among VCs] feels very strong."

Picks and shovels

Infrastructure players like Rvvup hold particular appeal, by supplying the so-called picks and shovels to the gold rush. “Crypto-adjacent” bets like NFTs also offer Europeans a less-complicated entry point to crypto, explains Ramp cofounder Szymon Sypniewicz.

“The startups coming out now are not as scary as protocols,” he explains. “Investors don’t need to hold tokens to invest."

Generalist funds like Mosaic, which was an unusually early investor in crypto, also say they’re seeing their mainstream peers join the fray.

[VCs are] subscribing to this new religion, at least in part. They’re dabbling

“[VCs are] subscribing to this new religion, at least in part. They’re dabbling,” says Mosaic’s Toby Coppel, who made his first crypto bet in 2014 with blockchain.com.

Indeed, annual crypto investment in Europe now stands at €2.7bn, up from €141m in 2019, according to Dealroom. That means crypto startups took almost 10% of the total investment into fintech in Europe this year.

The result is that the number of pro-crypto VCs in Europe is slowly growing, joining the collection of specialist funds in Europe. These specialists include Semantic, BlueYard Capital, Libertus, Outlier Ventures and Fabric Ventures, as well as crypto venture arms like Kraken’s and Blockchain.com’s.

There’s more funds in the works too, with Blue Lion Capital — led by Manu Gupta — set to be crypto-intensive when it launches.

Other fintech VCs have started investing by proxy too, with Entrepreneur First partnering with the Tezos Foundation to attract blockchain-first founders to its accelerator.

“They’re educating themselves [by investing],” agrees Kristina Walcker-Mayer, the chief executive of Nuri. “Many are investing in companies like ours just to understand all this.”

Nuri’s cap table includes Earlybird, Draper and other European investors who were early on the scene.

Hurdles to overcome

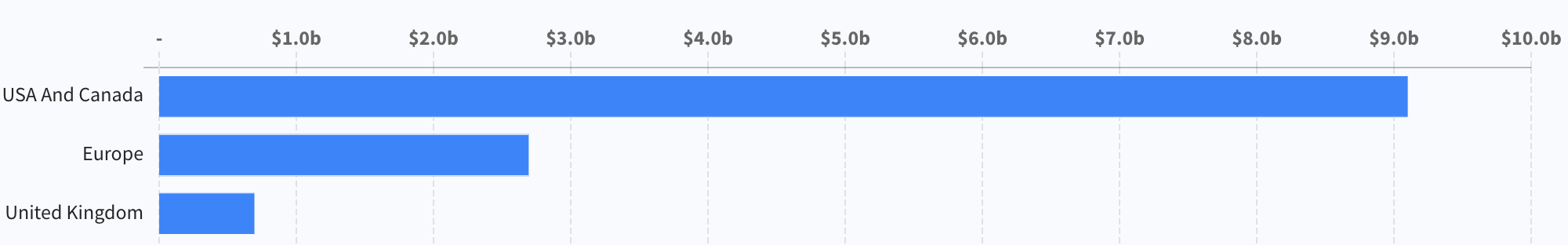

Mainstream funds may have begun backing crypto, but the cheque sizes are still small. European fundraising is a fraction of the US's, where crypto startups raised €9bn in 2021.

The institutional know-how is also still lagging at most European funds to make larger, late-stage investments.

“There is no crypto expert in every big VC in Europe,” says Lesuisse. “I haven’t seen in Europe a large VC that has [in-depth] understanding.”

By way of example, when Sifted interviewed Jan Hammer of Index Ventures earlier this year, he said he didn't know what "DeFi" was.

Lesuisse points out, moreover, that Europe hasn’t yet got the equivalent of Andreessen Horowitz or Union Square Ventures — traditional funds that have built out serious crypto arms.

Meanwhile, few European fintech investors have a serious thesis on the space, and many hold deep reservations about it.

"A lot of this is shady,” says Anthemis’s Amy Nauiokas (although Anthemis has made a handful of crypto bets).

It’s hard to blame them — crypto adoption is still relatively nascent, European regulators are nervous and digital assets have had some bad press, including outages for the Solana blockchain and UK regulators banning lending token Celsius.

If I were LPs in these big fintech funds, I’d be asking serious questions if they weren’t looking at crypto at all

Those hiccups will do nothing to diminish European VC’s conservatism. Cautious LPs won’t want their funds to double down on crypto, especially given the regulatory questions.

In short, not everyone is ready to make the move just yet, stresses Rvvup’s Nunn.

"We'll have some real forward thinkers, but the mass market will be thinking 'we'll see how it goes'. Lots will be thinking, ‘oh this will be a fad'... maybe they’ll wait until the explosion.”

The crypto pitch

Digital assets still have their issues, but it’s clear that they’ve become too important to ignore — even regulators and your grandparents are being forced to take them more seriously.

Indeed, VCs — particularly those focused on fintech — who don’t yet have a crypto thesis are “negligent”, in the words of Copper’s founder Dmitry Tokarev.

If nothing else because there’s potential that crypto disrupts fintech one day, he says.

Alokik Advani, an investor at Fidelity Ventures, agrees: “If I were an LP [in a fintech fund], I’d be explicitly asking whether they were looking into crypto. If not, I'd look for specialist crypto exposure. ”

Do I think it’s smart that they’re learning about it? Yes. Will all of this learning definitely pay off? No. Are they overpaying? Yes of course

Still, that doesn’t necessarily mean a blind rush into crypto is advised.

Investing in digital assets will ultimately require specialist VC hires, argues Mosaic’s Coppel.

“Do I think it’s smart that they’re learning about it? Yes. Will all of this learning definitely pay off? No. Are they overpaying? Yes of course,” he says. “You need to be very careful — you do need a technical background really... I don’t think people have thought this through at all.”

Another strategy, for those investors who want to dip their toes in, might be to follow firms like Fintech Collective, which has an entire crypto division doing due diligence on its crypto deals.

Or they might begin by participating by learning to stake, lend and vote on different blockchains. Others may wish to invest, but steer clear of anything that involves consumer risks, like Dawn has.

Europe’s crypto boom is undoubtedly beginning — but there are limits in how far VCs can go. “It’s not easy. Security is a huge issue here. People are forgetting that,” notes Coppel.

-

Check out the 17 blockchain startups to watch in Europe